A conversation with Senator Mitt Romney about the future of family benefits in the U.S. and what it means for the right-of-center's future.

Senator Mitt Romney sparked a critical debate with his introduction of the innovative Family Security Act, which would pay a monthly child benefit to all but the wealthiest American families. A similar provision included by Democrats in the $1.9 trillion COVID relief bill has been hailed for reducing child poverty, but it will expire next year, setting up a debate over how the U.S. will approach family benefits going forward.

On Thursday, March 18, Senator Mitt Romney joined us for a conversation about what draws him to this issue, why he thinks conservatives should embrace the Family Security Act’s approach, how he sees this debate fitting into the broader one about the right-of-center’s future.

Excerpted Comments by Senator Romney (edited for clarity):

On the importance of a monthly benefit:

One of the reasons we moved to the monthly payment was because right now, with the child tax credit, you get a refund or a substantial check when you file your taxes. So it might be $6,000 that comes when you file your taxes. Well, how’s that money going to get spent? Probably not on monthly food and clothes for the kids. It’s going to be spent on some major purchase, more than likely, if people act like I do when something comes in an unexpected way. And so moving to a monthly check means that we’re going to do a better job in supporting our kids, giving them a chance, perhaps to even go to a private or parochial school setting, a Catholic school, perhaps, but giving them the food and clothing support that they need.

On the importance of encouraging work:

I very much favor a policy of encouraging work. I don’t like the idea of people having a lifetime of government support and never getting into the workforce. You really do want to have people working and you want to encourage people to work.

[In our plan], we don’t eliminate the earned income tax credit. That is still there and so there’s a substantial incentive, which exists in our program and in the current law, to encourage people to work. That remains and so I want to encourage people to work. … I’m comfortable with the idea of saying, let’s say this person has worked in the past. That might be sufficient as an on-off switch for these benefits. But if someone said, “No, you’ve got to work at least, let’s say, $5,000 worth per year,” I’m okay with that.

I think I’d prefer a setting where we don’t connect work and childbearing in the same policy. So my own preference is to recognize that one thing I want to encourage here is family formation and childbearing. I also want to encourage and continue to encourage work. But I don’t know that I want to put those two things together. So, I want to make sure that we have incentives for people to go to work and to be participants in the work system. At the same time, I want to encourage people to have children and I want to support people who do have children, to make sure that the child is given the kind of care and treatment that we as a society want them to have.

On considering other proposals:

I would note that my plan is not a “take it or leave it exactly as it is” plan. I recognize that other people have good ideas—certainly Senator Lee and Senator Rubio do, I know you as well, Oren, you have some ideas in this regard. I’m open to those and think that if we make progress on this front, it’s going to be on a collaborative basis. And we’re going to have to have Democrats, not just a bunch of Republicans work on this or conservatives, but we’re going to have to have some Democrats look at it and it’ll change in some ways. But I think recognizing that our current programs are really not working in the way we’d hoped and that moving to monthly support and hopefully not raising taxes to pay for this, but instead finding pay force within the elimination of current programs, that that’s an approach that has some merit.

On the importance of Republicans having forward-looking policy ideas:

I think Senator Lee and Senator Rubio, I’m delighted that they have put out a plan as well. It just says, “Okay, this is an important topic. Republicans, we have a point of view here.” I’m afraid on too many things going on in Washington right now, Republicans are seen as not having a point of view other than “no.” And there are a lot of things that Democrats are doing where the right answer is no. But there are some topics where we have a better idea. And I think it’s important for us to lead with those ideas, and this is one area I think we can do that.

On the emergence of China as a serious geopolitical threat:

The thing that’s probably been most dramatic that’s changed in my perspective over the last almost 10 years is seeing China today as a power that is intent on dominating the world and replacing the liberal democratic order in the world, and the rules of the road for the economy, and for our military, and for the freedom of navigation, and the freedom of the skies and space. They intend on basically taking over the world. …

The world dominated by China is not like the world dominated by Great Britain or the United States. If you want evidence of that, look at what’s happening to the Uyghurs. I mean, there is genocide being undertaken against a population of a million people. And look what’s happened to the people of Hong Kong, promised self-rule given the heavy hand of the Chinese Communist Party. And I’m sure the Tibetans would have a lot to say as well about life under Chinese rule.

That is probably the single most dramatic change on the world stage that I think requires us to concentrate even more fully on making sure that everything we’re doing strengthens us, it keeps our economy strong, allows us to lead, and allows us to have the moral and economic strength to bring together the other nations of the world to keep China from trying to change the kind of world that we think would be best for freedom and for the people of the world.

Full Transcript

Oren Cass: Good afternoon and welcome to this American Compass event. My name is Oren Cass. I’m the executive director at American Compass, and we are thrilled to have Senator Mitt Romney joining us this afternoon to talk about family policy. As some of you may know, I had the privilege to work for then Governor Romney on his 2012 presidential campaign and have certainly been an avid follower of his work since then. And as we’ve all seen, he, I think started a very important debate, particularly among conservatives in the past month with his introduction of the Family Security Act, which was a proposal to create a universal child allowance, supporting families with children. American Compass has been doing a lot of work in this space as well. We hope you’ll check that out at americancompass.org and our own proposal for what we call the Family Income… Excuse me, the Family Income Compliment. And with that, I don’t think Senator Romney needs any more introduction. So I will bring him in. Thank you so much, Senator Romney.

Sen. Mitt Romney: Thank you so much. There, we got that to work, Oren. Good to see you. Appreciate the chance to be with you and your team and look forward to our conversation.

Oren Cass: Yes. And I think we want to start off with just a few slides to run through what exactly the proposal is that you’ve been working on.

Sen. Mitt Romney: Yeah. And just a moment. Let me just note, if you will, the impetus for what we put together. And I note, that this was my team that worked on this and brought the idea to me and I signed on. So it’s not like I had this brilliant insight and then told them, “Hey, I want you to come up with something.” They went the other way around. But the observation that I’ve had, and that I think many of us in the conservative world have had, is that we’ve seen the birth rate in this country go down, down, down. And people are not getting married and not having kids. And the preservation of a civilization, and a nation of a society is related of course to maintaining its population.

As a matter of fact, if you go back to 2008, and if we had had the same birth rate over the last 12 years that we had in 2008, we would now have 5.8 million more Americans having been born. So the declining birth rate has cost us some 5.8 million young people, who 18 years from now, or 20 years from now, would be contributing to our economy. So it’s a real concern. And so we said, what is it that’s wrong with our family support systems in this country that’s not helping families encouraging them to get married and to have children. So that’s what led to our proposal. So with that, let’s turn to the first slide. And let me just describe what we do.

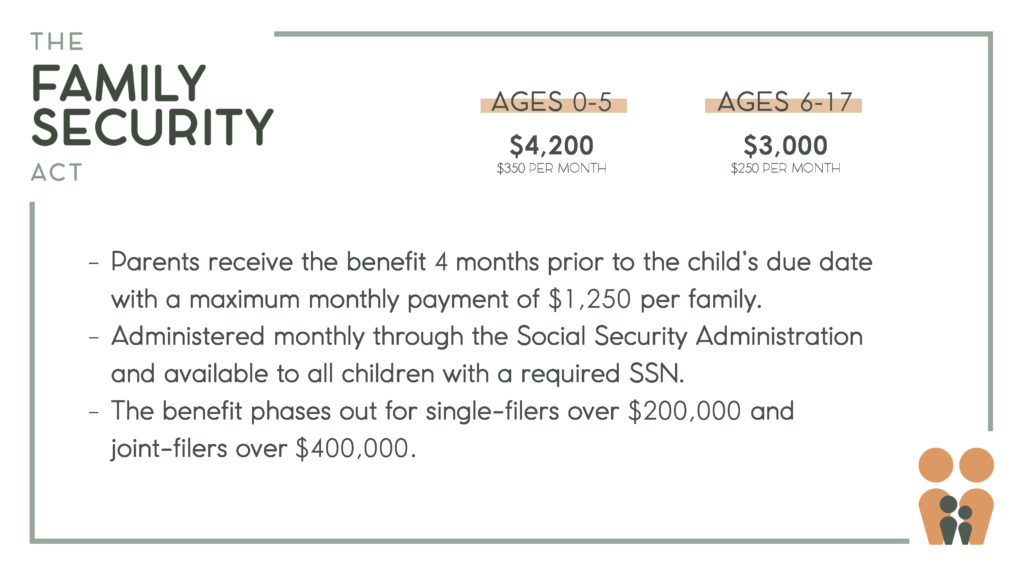

There we go. All right. Under our plan, parents receive a benefit, a monthly benefit, and they should begin receiving it four months prior to the time the child is due. This is to help pregnant women who are concerned about the financial circumstances of bringing a child into the world. And so we want to have the payments start within four months of the due date. And the maximum payment is $1,250 per family, per month. So for children, six years of age and younger, it’s $350 a month. For kids six years and older, it’s $250 a month. The payments are administered by the Social Security Administration. And so all of our kids are going to need to have a social security number.

And I note that the phase out in terms of income for this program is at pretty high income levels. So for a single filer, it phases out at $200,000. And for a joint filer, a couple, in other words, it phases out at $400,000. So this is a monthly payment that’s going to support children and having children, not just to the poor, but to middle-income families and almost some higher income families at 400,000 per month. So it’s designed to be a very substantial incentive for marriage, family formation, as well as for having kids. Let’s go to the next slide.

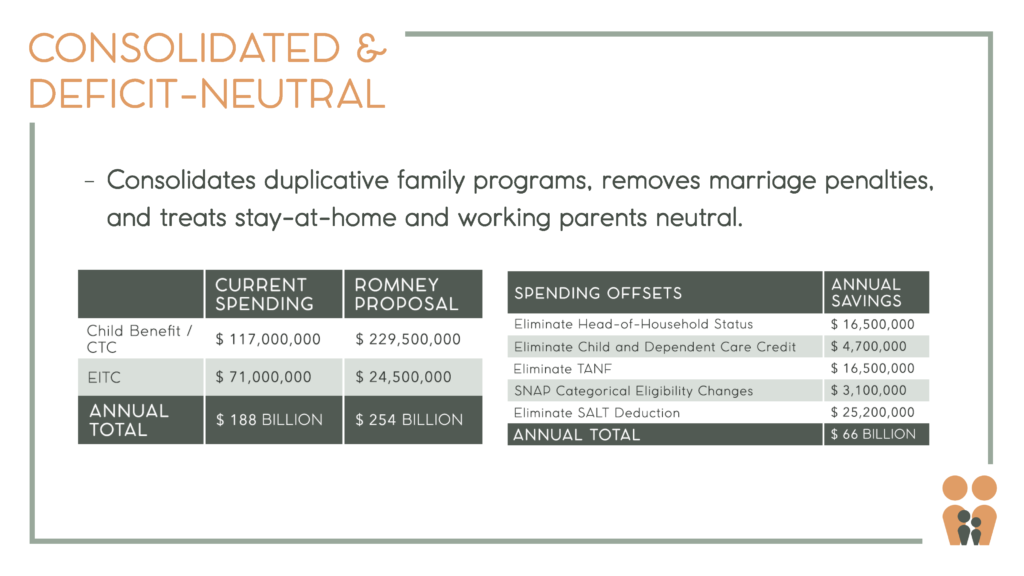

Just to describe the current programs. Right now, look on the left-hand side. I’ll note that our objective is to consolidate duplicate family programs, to remove the marriage penalties that exist in our current systems, and to treat stay-at-home and working parents the same.

We don’t want to create a requirement that, let’s say a couple, a man and a wife that, let’s say the wife wants to go to work. The husband wants to stay home and raise the children. We don’t want to penalize that individual for making that choice. Under the current plan, we spend roughly $188 billion. You see on the left-hand side of this slide, that’s a child tax credit, which costs us 117 billion a year. And the earned income tax credit of 71 billion a year, for a total of 188. The proposal that I’m making is that we change the child tax credit instead to this monthly child benefit that costs the $229 billion. And then the earned income tax credit goes down. It’s still there of course, to provide an incentive for work. We love work. We want people to work. But the child portion of the earned income tax credit is eliminated.

So our cost is 254 billion instead of 188 billion. So that means we’re going to have to find $66 billion if we want to have this as a revenue-neutral proposal. And there’s no hard and fast insistence on these pay for spending offsets. But those that we identified are to eliminate the head of household status tax filing credit. That is something, by the way, we’re the only country that has that. It is a marriage penalty that doesn’t exist in other nations and probably shouldn’t in ours. We eliminate the child to develop a care credit, eliminate TANIF. And I’d note TANIF works in some states, not in others. Those who love TANIF will argue with me on that. And maybe we’ll find another place to find an offset. And then finally, the SNAP categorical eligibility changes of 3.1 billion. And then eliminate the SALT deduction, as you know, SALT is highly associated with higher income folks.

So this is something that takes away that benefit to high-income folks. And therefore, we came up with the 66 billion. Let’s go to the next slide.

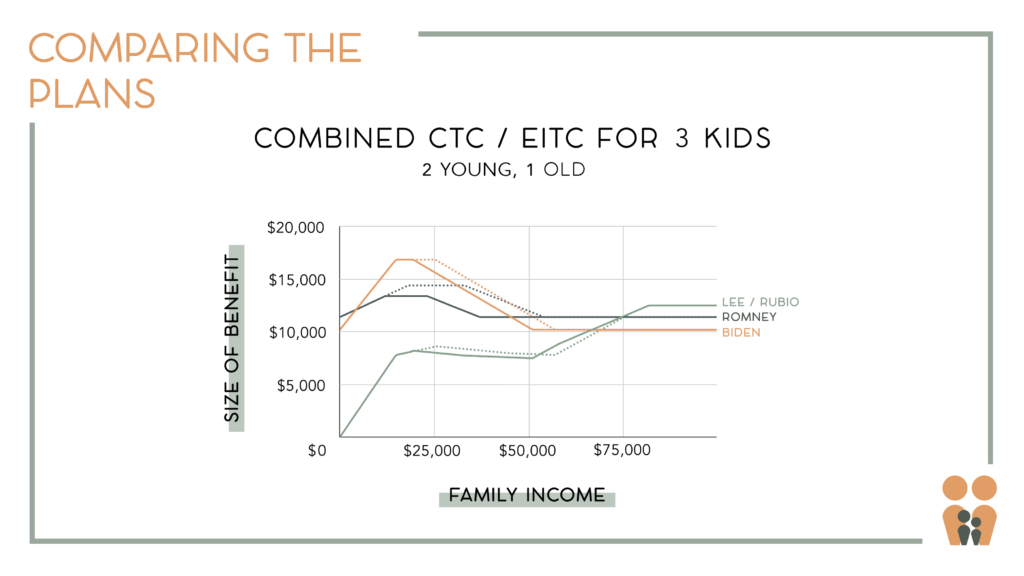

And this was going to be the hardest for me to describe. On the left is the size of the benefit that is available to the sample that we’ve chosen. Which is looking at a couple with two young people, two children… And excuse me. Two young children, one older child. So two young children getting $350 a month, one older child getting $250 a month. And it’s a couple, a husband and wife. And on the bottom, you see family income, and it ranges from zero here to about 100,000. So looking at the different plans, my plan is the dark line in the center. The plan that’s been described by Senators Lee and Rubio is the, I think it’s kind of a greenish line towards the bottom.

And then the orange line is the line that’s proposed by President Biden. What you’ll notice that my plan has a relatively flat level of support going all the way across the income levels. In terms of differences relative to the other plans, you’ll note that on the Biden plan, he has a substantially higher amount at very low incomes, under 25,000. And then brings it down pretty quickly and substantially. On the Lee and Rubio plan, you’ll notice that until you get to about 75,000 of income, that plan has substantially less support for children at the lower income levels. And perhaps the biggest difference is at the very, very low end, which is a zero to about $12,000, the Lee and Rubio plan is very, very low indeed. And the plan that I proposed has more support for very, very low income families. So that’s the outline. And with that, I’ll turn it back to you, Oren, for any questions you might have.

Oren Cass: Terrific senator, thank you for providing the overview. I think as anyone listening gets the sense, there’s obviously a huge number of variables that go into this sort of proposal and so I’d love to sort of talk through the thinking and the rationale that that goes into a few of them.

I think the one that’s probably been the focus of the most attention and debate is exactly what you highlighted on the contrast between your proposal and the one from Senators Lee and Rubio at the sort of very low-income end of the threshold and at the sort of $0 amount.

That is, if you have a household that’s not earning any income of its own, certainly the traditional view on the right of center has been, we want to provide a safety net to those folks but we don’t think we want to sort of send them large amounts of cash. And so I’d love to sort of dig in there first on your thoughts on why we want to move to a model that says, even if you’re a household that isn’t working at all, we have up to a thousand dollars a month may be coming from the government.

Sen. Mitt Romney: Well, let me describe two scenarios. One is one where there’s no work at all in the household. And the other is, let’s say a family earning minimum wage; so they’re at $17,000 a year, and what’s the difference to do those two scenarios.

For those that are earning nothing at all, would presumably be a single parent and if it’s a single parent with two or three children, the question is whether we as a society, want to encourage the mom to leave the home, or if it’s a dad, the dad to leave the home and to work, or whether we might instead look back at their work experience prior to having children. I’m not entirely averse to saying, “All right, you have to show some history of work or be able to get some job.”

But I do think that if you have someone, for instance earning $5,000 or $10,000 in their household to say, “We’re not going to give you much money to take care of your children.” One, I don’t know that that’s good for the kids. I think we have a societal interest, one in encouraging people to have children and number two, having a certain amount of support per child.

One of the reasons we moved to the monthly payment was because right now, with the child tax credit, you get a refund or a substantial check when you file your taxes. So it might be $6,000 that comes when you file your taxes. Well, how’s that money going to get spent? Probably not on monthly food and clothes for the kids. It’s going to be spent on some major purchase, more than likely, if people act like I do when something comes in an unexpected way.

And so moving to a monthly check means that we’re going to do a better job in supporting our kids, giving them a chance, perhaps to even go to a private or parochial school setting, a Catholic school, perhaps, but giving food and clothing support that they would need. So if there’s an on-off switch for whether someone has any work, I understand that. But I do think that even at low incomes, you don’t want to say to people, “Hey, we’re not going to support children any more than you’ve paid in taxes.”

So for instance, if you look at something like Medicare. People pay into Medicare all their lives, but we don’t limit how much you receive in Medicare based on how much you’ve paid during your lifetime. Likewise, with Social Security. Social security disability, or old age, we don’t limit how much you get from these programs by how much you’ve put in. But we do insist that you’ve worked obviously and have contributed to the programs in the first place other than for the disabled.

So I think the philosophy is, let’s support families and encourage family formation and childbearing and not if you will, have lower support for families of low income than we do for families that are earning, let’s say $25,000, $50,000, or $75,000.

Oren Cass: Yeah. That’s a terrific point I think about the family that’s earning 15 or $20,000 a year. You can imagine the single parent with a part-time minimum wage job, let’s say, but I think you, you raised the interesting hypothetical. So let’s say you have a single parent, maybe with young kids. Should public policy prefer work over no work? I think you emphasize if you have a two-parent household and one parent might want to stay home, we certainly don’t want to discourage that, where you only have one parent in the household, of course, now you face a much sharper trade-off between time with the family and time in the workforce.

So I’m curious if from your perspective, is it better for policy to truly be agnostic on that question, or would you see it as important to say, “We don’t necessarily want her working three shifts, or we don’t want him working three shifts but we do see the value in at least some time in the workforce, even if that means some time away from kids.”

Sen. Mitt Romney: Well, first of all, I very much favor a policy of encouraging work. I don’t like the idea of people having a lifetime of government support and never getting into the workforce and not participating in the workforce. So you really do want to have people working and you want to encourage people to work.

One thing I noticed that we don’t eliminate the earned income tax credit. That is still there and so there’s a substantial incentive, which exists in our program and in the current law, to encourage people to work. That remains and so I want to encourage people to work and I don’t know that I’m going to make the societal decision of if there’s a mom, single mom with two kids, do I want her to be working when they’re little? When they’re one and two years old? Do I want her working when they’re five? I mean, I can make those judgments, but I’m not sure I want to apply those necessarily to society at large.

So, I’m comfortable with the idea of saying, let’s say this person has worked in the past. Okay, that might be sufficient as an on-off switch for these benefits. But if someone said, “No, you’ve got to work at least let’s say $5,000 worth per year.” I’m okay with that. I think I’d prefer a setting where we don’t connect work and childbearing in the same policy.

So my own preference is to recognize that one thing I want to encourage here is family formation and childbearing. I also want to encourage and continue to encourage work. But I don’t know that I want to put those two things together. So, I want to make sure that we have incentives for people to go to work and to be participants in the work system. At the same time, I want to encourage people to have children and I want to support people who do have children, to make sure that the child is given the kind of care and treatment that we as a society want them to have.

Oren Cass: Yeah and that’s… I think that’s a really important point that at the end of the day, you’re talking about the welfare of the children, who of course are not the ones who decide whether to work or not and so that’s certainly a factor as well.

Sen. Mitt Romney: I’d also note, just my team has pointed this out to me and I haven’t seen all the data on this, but they say there are a number of other countries which have moved to it, a setting much like what I’ve described, and there was some question about whether this would lead people to become less inclined to work.

The result in other countries has been just the opposite. That for whatever reason is, as they went to a monthly or regular payment schedule and did not have a work requirement that nonetheless, more people ended up going back to work and it may well have just been the greater confidence they had that they could care for their children, that allowed them to take on part-time work or other jobs, but people went back to work.

So clearly, if we’re talking about the few cases where it’s a zero income person, we can look and see what the experience is before we rush to a final judgment.

Oren Cass: Yeah. It’s an interesting point and I think distinguishes between the sort of the practical case and the principled case and of course it makes no sense to consider the principle without the practical implications. I think conversely, there’s an important consideration of kind of what are the principles that motivate the policy design and so I’d love to talk a little bit about what this kind of thinking means for conservatism and for the right of center and the GOP going forward.

One point that you made in comparing your proposal to the Rubio/Lee one was to emphasize that you don’t want to gear how much support a family should receive toward how much they might have paid in taxes. That’s not what we do with Medicare. It’s not what will you do with Social Security and it’s a somewhat arbitrary linkage. I think the traditional view among Republicans would be, well, we believe in making the tax code as fair as possible and using it to do things like support families, but that’s a very different matter from what would look more like redistribution, that is we simply tax some people and send the money to others. And they would say, well, this goes over that line. Once you disconnect this from the tax code, this truly is just collecting money from some people and sending it to others. One answer is that’s fine, and we should do it, but I’m very curious how you, whether you see that division as an important one and how it would factor into this kind of policy.

Sen. Mitt Romney: Well, I’m just looking at a circumstance and saying, all right, let’s say we’ve got a young couple. And I think in most cases we’re talking about across the country, these are couples, young couples that have one or two children, and you have a spouse, or perhaps both of them that are working at very low-income levels, they’re early in their career and they probably have, maybe they have some student debt as well, but in many cases, they’ve not graduated from college or gone to college. So let’s say they’re earning $25,000 a year or $15,000 a year combined.

And the question is, what do we want to do as a society with regards to encouraging them to have children and supporting the children that they have? And I think it is in our society’s interest not to say to them, I’m sorry, you haven’t done enough money to get the $350 a month. You’re only going to get $122 a month because you haven’t earned enough money. Or do we say, as a society, we value your children. We value the support that you’re going to be able to give the child in terms of food and clothing and so forth, education. And so we as a society are going to provide the kind of support that you would need, the same support for your children, that someone who’s earned 30,000 or $40,000 a year would get. And so I fall on that side.

I think there are a number of things that are very conservative in approach. One is we’re making payments to the young women that are pregnant within four months of their due date. As I indicated that among those that have abortions, some 70% say the reason or one of the key reasons that they had an abortion was because they were concerned about their financial capability in caring for the child. So providing a monthly stipend to someone who is pregnant is very much a pro-life consideration.

Likewise, I believe that encouraging family formation and childbearing, particularly in a society that would have had 5.8 million more people if we’d have had the same birth rate as we had in 2008, over the last 12 years, that’s a very conservative orientation, which is to maintain our civilization and our society. So, we can question whether people should get more than they paid in taxes. But again, I note that with regards to our retirement programs and our disability programs, that’s not a requirement.

Oren Cass: Very interesting. And it points to the, I think as you alluded to sort of be the economic challenges, it sort of points to in my mind anyway, how this fits into the sort of broader debate that is increasingly going on on the right of center, about what role public policy needs to play, especially economic policy, in addressing some of these challenges that the country has. And so putting this proposal in that context, I think it is implicit in the case that you’ve made, but it is harder now for a family to support kids than it might’ve been in the past, if that is part of the reason for the childbearing decline. How would you describe your assessment of what has happened in the economy and what makes this policy may be needed more now than it would have been in the past?

Sen. Mitt Romney: I do believe, based upon not just experience but what I’m reading, that there’s a lot more employment uncertainty on the part of young people where they’re coming out of high school or coming out of college as to their permanence in their job and their reluctance to marry is one of the elements of that. Likewise, the decision to delay having children is likewise associated with that. That’s just the new reality. I mean, when I was growing up, people went to work in a company and the great majority of people did, I did, and planned on staying for a long time. That’s just not the case today. And obviously, the COVID crisis has exacerbated the concerns people have about income or workforce insecurity. And so I think that suggests, as well as the simple data which is the decline in birth rates, that what we’re doing, we’re spending $500 billion a year supporting families, but it ain’t working, we’re not getting it to people at the time and in the manner they need it.

And I would note that my plan is not a take it or leave it exactly as it is plan. I mean, I recognize that other people have good ideas, certainly Senator Lee and Senator Rubio do, I know you as well, Oren, you have some ideas in this regard, I’m open to those and think that if we make progress in this front, it’s going to be on a collaborative basis. And we’re going to have to have Democrats, not just a bunch of Republicans work on this or conservatives, but we’re going to have to have some Democrats look at it and it’ll change in some ways. But I think recognizing that our current programs are really not working in the way we’d hoped and that moving to monthly support and hopefully not raising taxes to pay for this, but instead finding pay force within the elimination of current programs, that that’s an approach that has some merit.

And what we’re seeing instead from the president is saying, “Hey, I’m going to take the current child tax credit, and I’m going to make it even bigger.” It’s like, well, great, that means that even bigger check for people to get at the end, perhaps. And of course, it’s a pretty steep curve based upon people’s income. I think there’s a way to say, hey, let’s reconsider how we design the program from the very start and see if we can come up with something that’s really the most effective. And part of what we did was look at what’s being done in some other countries and saying, hey, that seems to be having a positive effect there.

So getting back to your question, I think the realities of the kind of employment insecurity people feel today are part of a reason why we need to rethink how we provide the support for kids.

Oren Cass: The contrast to the Biden plan, of course, is interesting because that only is here for one year. So we are almost sure, in probably starting this week, but certainly in the months to come to see a tremendous amount of debate of, okay, well, what comes next? Do we make this permanent? Do we go to something that looks more like the Romney proposal or the Rubio Lee proposal? I’m curious, as you’ve talked with colleagues on both sides of the aisle, what your read is on how that debate might evolve or beyond, obviously just to your plan where you would want it to see it evolve. Where do you think there’s the most common ground, and where do you see there kind of being the most conflict to resolve at this point?

Sen. Mitt Romney: Well, I think the Democrats are going to have a difficult time deciding what of all the things that they promised that they’re going to give people for free they’re actually going to do, and how are they going to pay for it? And no question, they intend to raise taxes through the reconciliation process. But they have so many things, whether it’s college tuition, reduction in college loans, whether it’s a green new deal, investments in K through 12, and of course these child support efforts. I mean, this is a multi-hundred billion dollar effort that the president has proposed, so how are we going to pay for it in a non-emergency year? And I don’t know that they have confronted yet the cost of all the things that they want to do. And so I agree with you. I know there’s going to be enormous pressure on the part of the Democrats to say, you’ve got to continue this program that the president put in place during COVID. And by the way, that’s not just going to apply to kids. There’s going to be enormous… People going to say, “Hey, I got a $600 check, and then I got a $1,400 check. Where’s my check this year? I want another check.” We’re creating an expectation in our country that that is going to be hard to meet. And that’s why I’m encouraged that I’ve had a number of senators… Frankly, the Democrats have paid more attention to my proposal so far than have Republican senators, but I’ve had a number of Democrat senators come by and say, “I think you’ve got an interesting proposal. I’d like to take a close look at it. I think we need to make progress on this front.” There are some folks by the way, who said, “Hey, look, I like TANF. I like the connection TANF gives to individuals, to young couples, and so forth to make sure they’re getting in the workforce, they’re getting an education, just checking up on them.”

TANF works in some states. There are some other states where the money is kind of used as a budget filler, where there are gaps and it’s not used as effectively as another. So I’m open to saying, “Okay, let’s keep certain elements of TANF that may be working. But, the recognition that we need to adjust our programs I think is pretty substantial. And I think interestingly enough, the president having put a bunch of money in this new child tax credit in his $1.9 trillion COVID Relief Bill is going to focus more attention on, “Okay, what are we going to do next year?” And I’m not afraid of that because I got a proposal there, but I think it’s going to be a very challenging environment to find common ground between Republicans and Democrats. But I think that’s got to happen.

I think Senator Lee and Senator Rubio, I’m delighted that they have put out a plan as well. It just says, “Okay, this is an important topic. Republicans, we have a point of view here.” I’m afraid on too many things going on in Washington right now, Republicans are seen as not having a point of view other than no. And there are a lot of things that Democrats are doing, but the right answer is no. But there are some topics where we have a better idea. And I think it’s important for us to lead with those ideas, and this is one area I think we can do that.

Oren Cass: It’s discouraging and encouraging at once I guess. I think we have time for one more question, and I’m excited to ask you one that I get asked all the time, and now I get to turn around and pass it on, which is looking back to 2012, as opposed to today, obviously there’s a whole different issue set that is under debate. There’s a different set of concerns. Both parties are in different places. I’m concerned as you think about your own work during… Or curious as you think about your own work during this time, are there any particular landmarks, things you learned along the way, things that changed out there in the world that have really changed how you think about things, or where you focus compared to where you had in the past?

Sen. Mitt Romney: It’s embarrassing to say, I wasn’t entirely right on all issues back in 2012, even though I had a brilliant policy director.

Oren Cass: You did alright. We have our shirts that say, “Don’t blame us. We worked for Romney,” so nothing to worry about there.

Sen. Mitt Romney: I guess the thing that’s probably been most dramatic that’s changed in my perspective over the last almost 10 years is seeing China today as a power that is intent on dominating the world and replacing the liberal democratic order in the world, and the rules of the road for the economy, and for our military, and for the freedom of navigation, and the freedom of the skies and space. They intend on basically taking over the world.

We could see them emerging in 2012, but they weren’t as great a focus as I think they need to be today. And so, as we look at at the policies domestically that we put in place, I think we recognized that there’s a high degree of concern that we remain a strong and vibrant economy, not just for the wellbeing of our citizens, that’s a huge priority, but also to make sure that we can sustain the military, sustained the education system, the technology and innovation systems, that allow us to push back on China and to encourage China through our strength, and through the strength of our allies, with who we link arms, to get them to finally play by the rules. Because the world dominated by China is not like the world dominated by Great Britain or the United States.

If you want evidence of that, look at what’s happening to the Uyghurs. I mean, there is genocide being undertaken against a population of a million people. And look what’s happened to the people of Hong Kong, promised self-rule given the heavy hand of the Chinese communist party. And I’m sure the Tibetans would have a lot to say as well about life under Chinese rule.

That is probably the single most dramatic change on the world stage that I think requires us to concentrate even more fully on making sure that everything we’re doing strengthens us, it keeps our economy strong, allows us to lead, and allows us to have the moral and economic strength to bring together the other nations of the world to keep China from trying to change the kind of world that we think would be best for freedom and for the people of the world.

Oren Cass: Well, we will have to leave it there. Senator Romney, thank you so much for all the work you and your team do on thinking about these policy issues, for doing it in an open-minded way that I think really moves the discussion forward, and for joining us today. I really appreciate it.

Sen. Mitt Romney: Thanks so much, Oren. Good to be with you.