Archive of Returns Counter data as of Q2 2020

RECOMMENDED READING

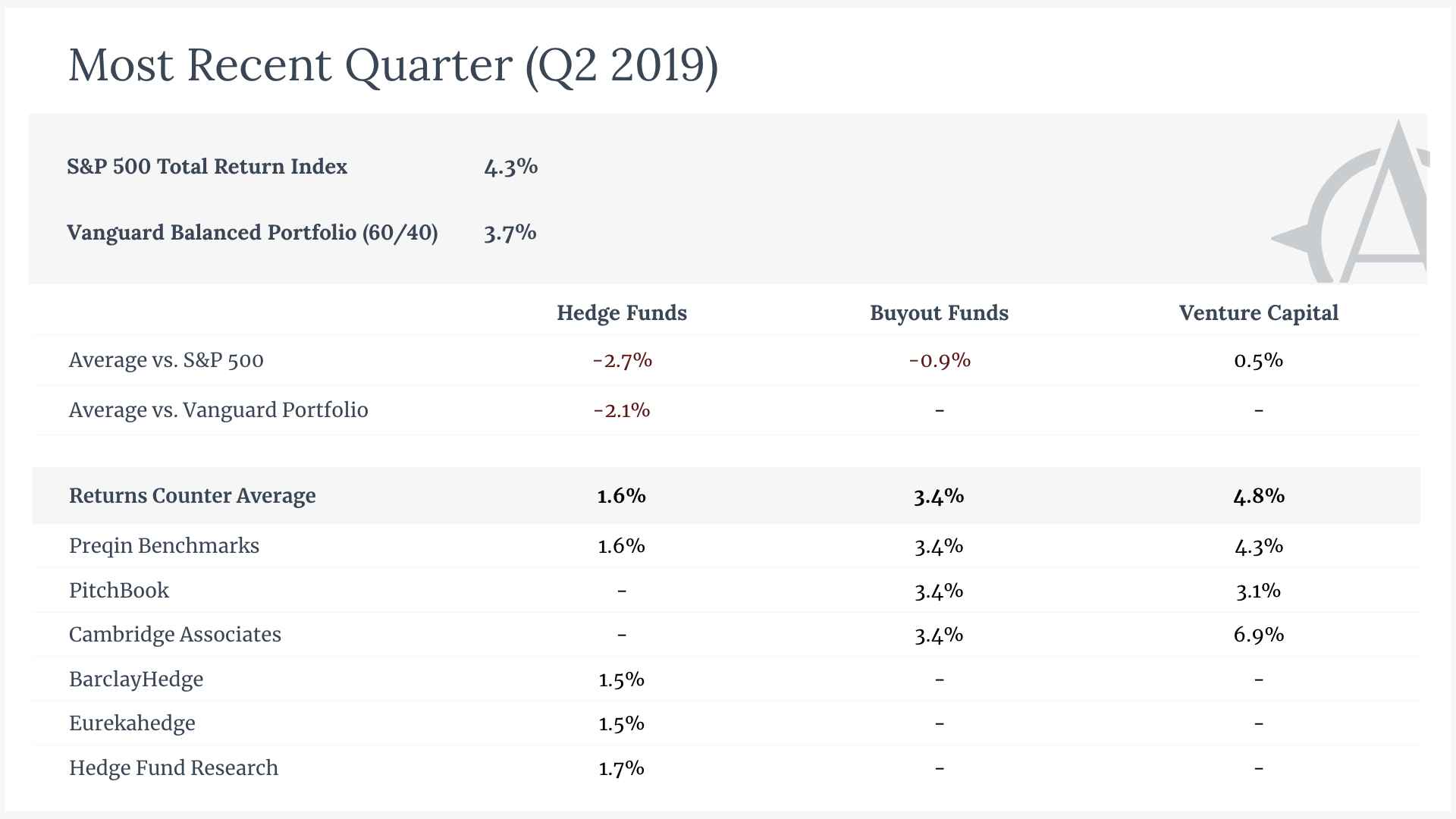

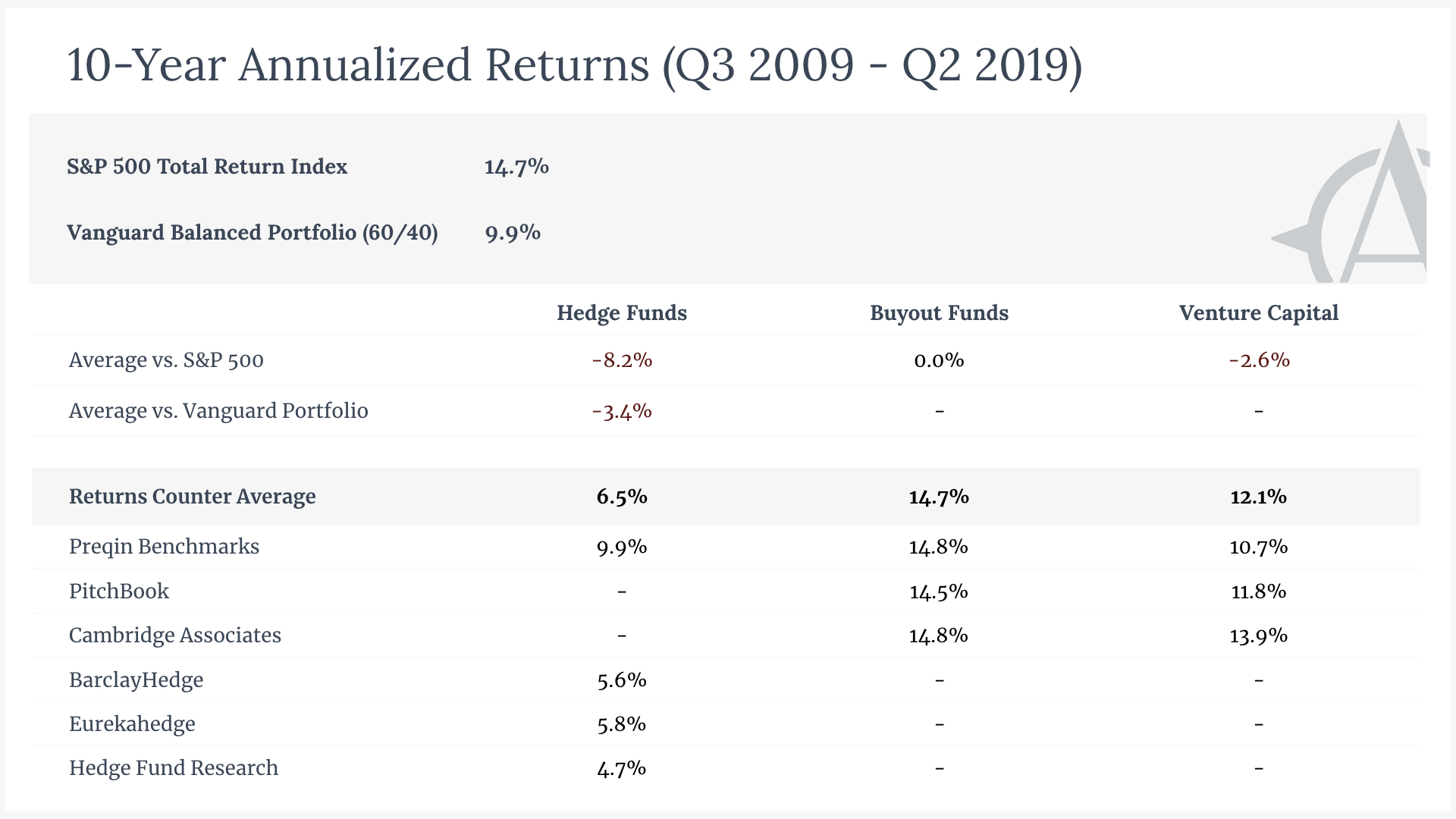

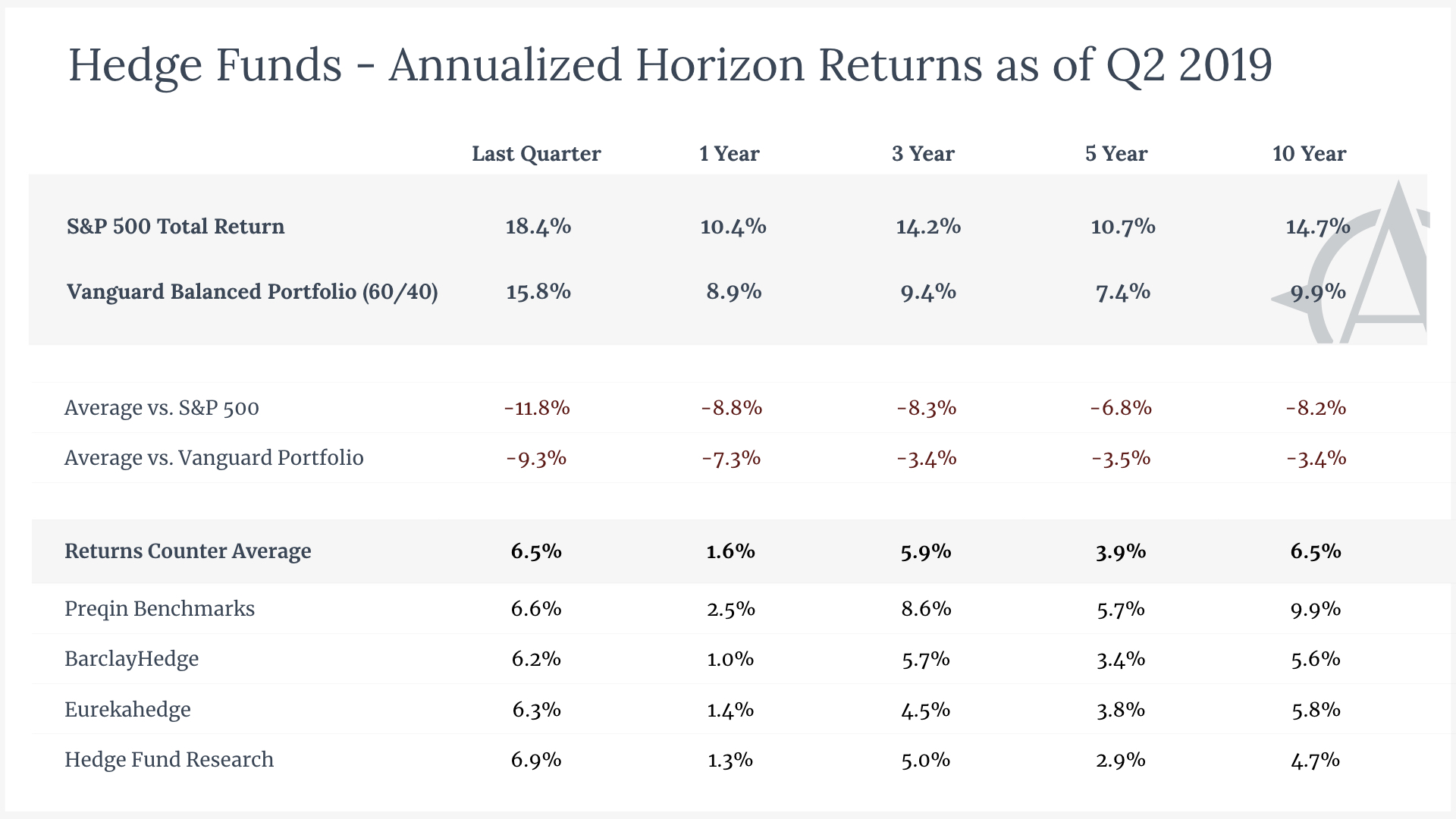

The worlds of hedge funds and private equity are notoriously opaque. The Returns Counter aims to shed light on the overall performance in these industries as a starting point for understanding their claims of economic value. The Counter aggregates returns data from multiple sources to create a simple metric—a “Returns Counter Average” that can be directly compared against public market benchmarks.

The Returns Counter is part of American Compass’s Coin-Flip Capitalism project. For more, start with Coin-Flip Capitalism: A Primer.

Hedge Funds

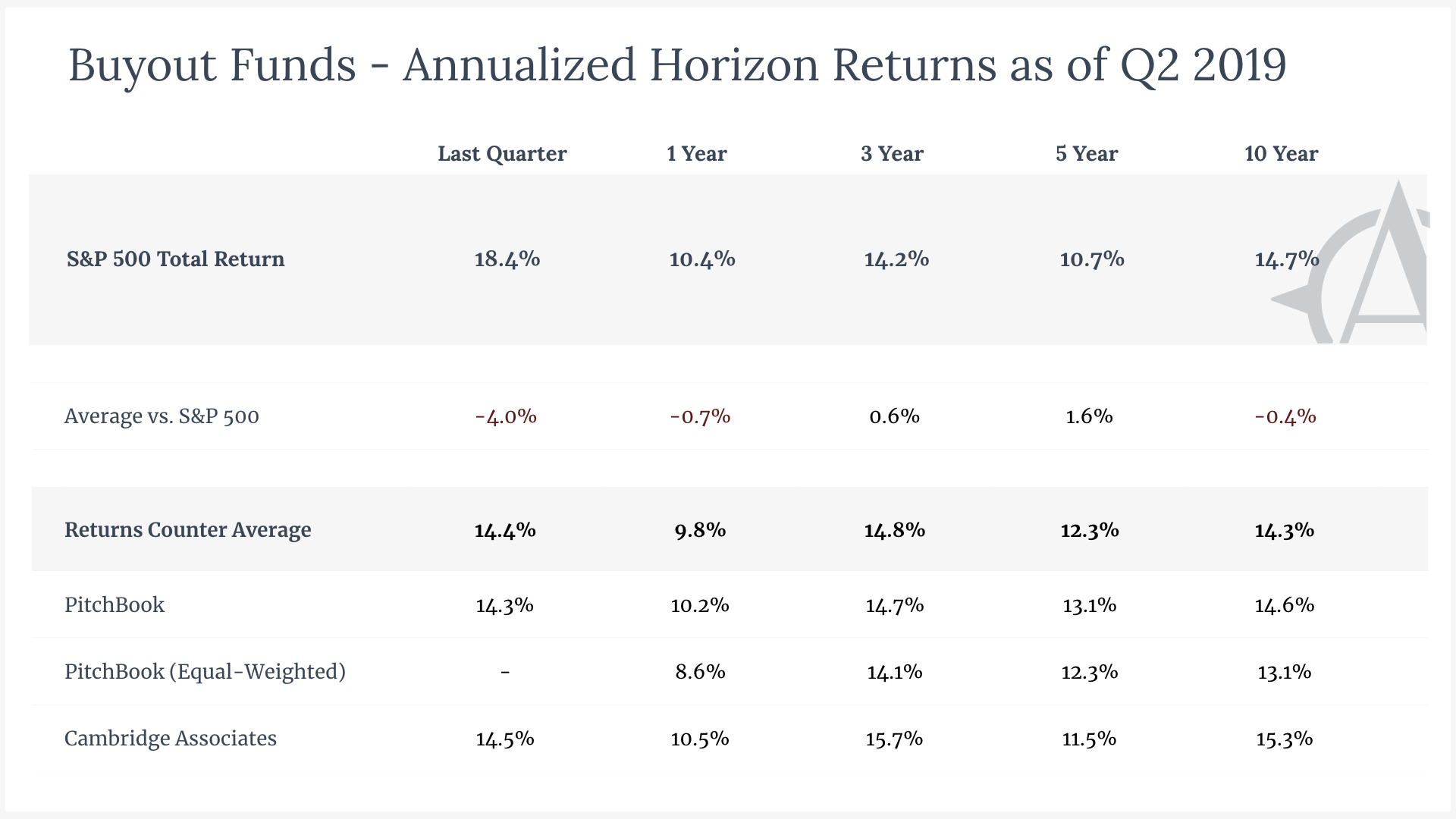

Buyout Funds

Venture Capital

Market Benchmarks serve as a proxy for performance in the stock and bond markets. The S&P 500 Index is a conventional benchmark for assessing the performance of the U.S. stock market. It includes the stock of 500 large companies traded at NASDAQ and the New York Stock Exchange and represents approximately 80% of available market capitalization. The Vanguard Balanced Index Fund (VBIAX), which offers a balanced portfolio allocated 60% to a broad U.S. stock market index and 40% to a broad U.S. bond market index, reflects performance of a balanced portfolio with broad exposure to the U.S. equity and bond markets.

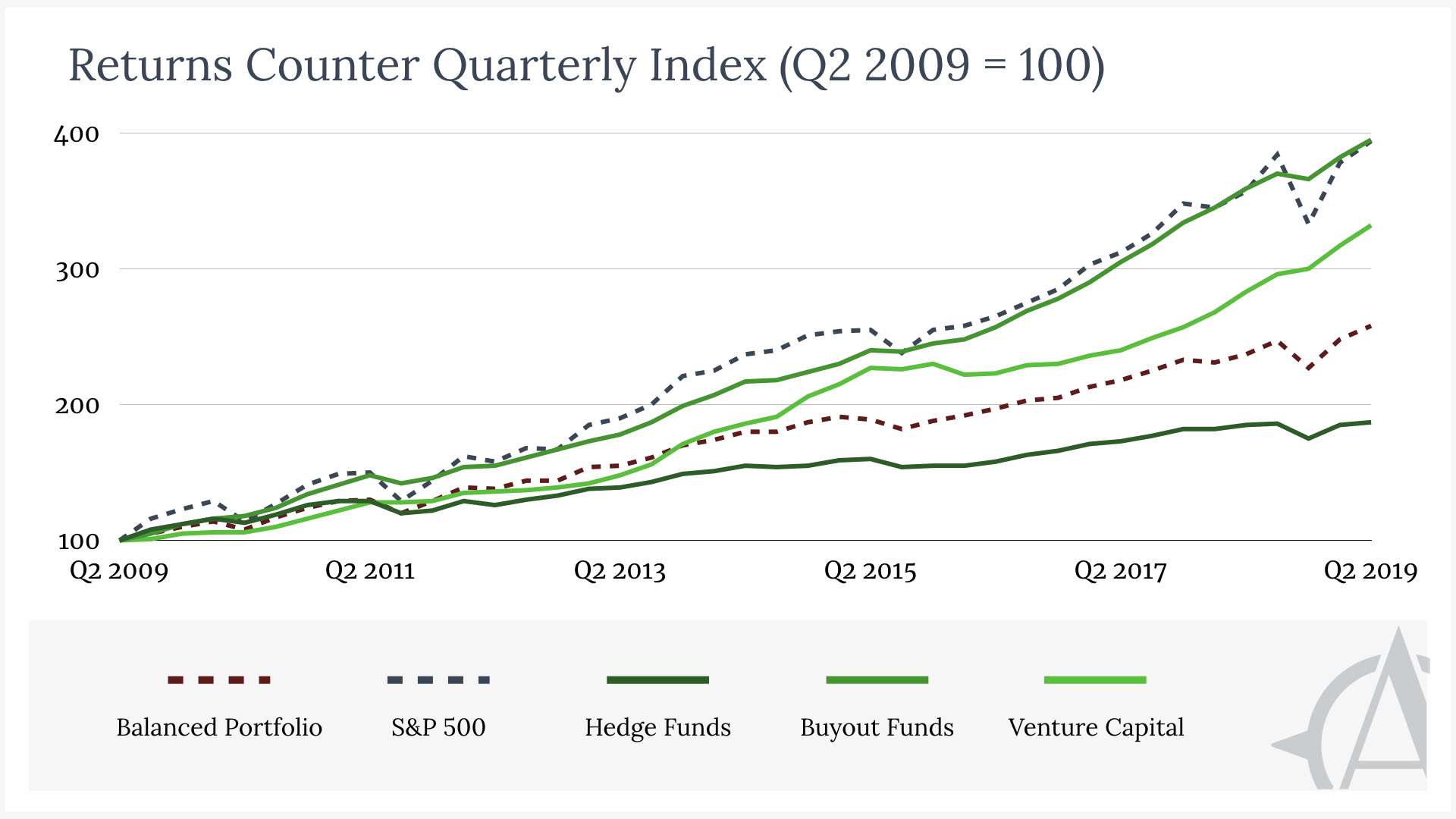

Quarterly Index provides a simple portrait of performance over the preceding decade. The figures represent what an investor could expect to earn from a $100 investment across any asset category, calculated by aggregating and compounding the returns reported each quarter over the ten-year period.

Horizon Returns measure performance over different time frames—including the preceding quarter and year. All figures are annualized. Hedge fund values are calculated as simple returns on investment. Buyout and venture capital figures reflect a different measure: internal rate of return (IRR), the conventional metric used by private equity firms to calculate the returns delivered to investors. Research firms calculate horizon returns independently from quarterly estimates, so ten-year horizon returns may differ slightly from the aggregated ten years of quarterly returns reported for the Quarterly Index.

Recommended Reading

The Returns Counter

Comprehensive benchmarking of the hedge fund, private equity, and venture capital industries against public-market indexes, updated quarterly.

Coin-Flip Capitalism: Q2 2021 Update

A review of hedge fund and private equity performance through the COVID-19 market crash.

The Returns Counter (Q3 2019)

Archive of Returns Counter data as of Q3 2020