RECOMMENDED READING

China’s economic rise and the damage inflicted on U.S. industry has been a wakeup call to many U.S. policymakers. But most conventional economists continue to hold firm to their ideological notion that only the market can respond, and that any more proactive government action, particularly focused on key sectors or technologies, is doomed to fail. For many, the only choice is between China’s command-and-control playbook and the market, albeit one perhaps supported by a bit more spending on education and research. This is ideological framing of the first order, grounded in neither logic nor research. The reality is that government is best positioned to “pick winners.”

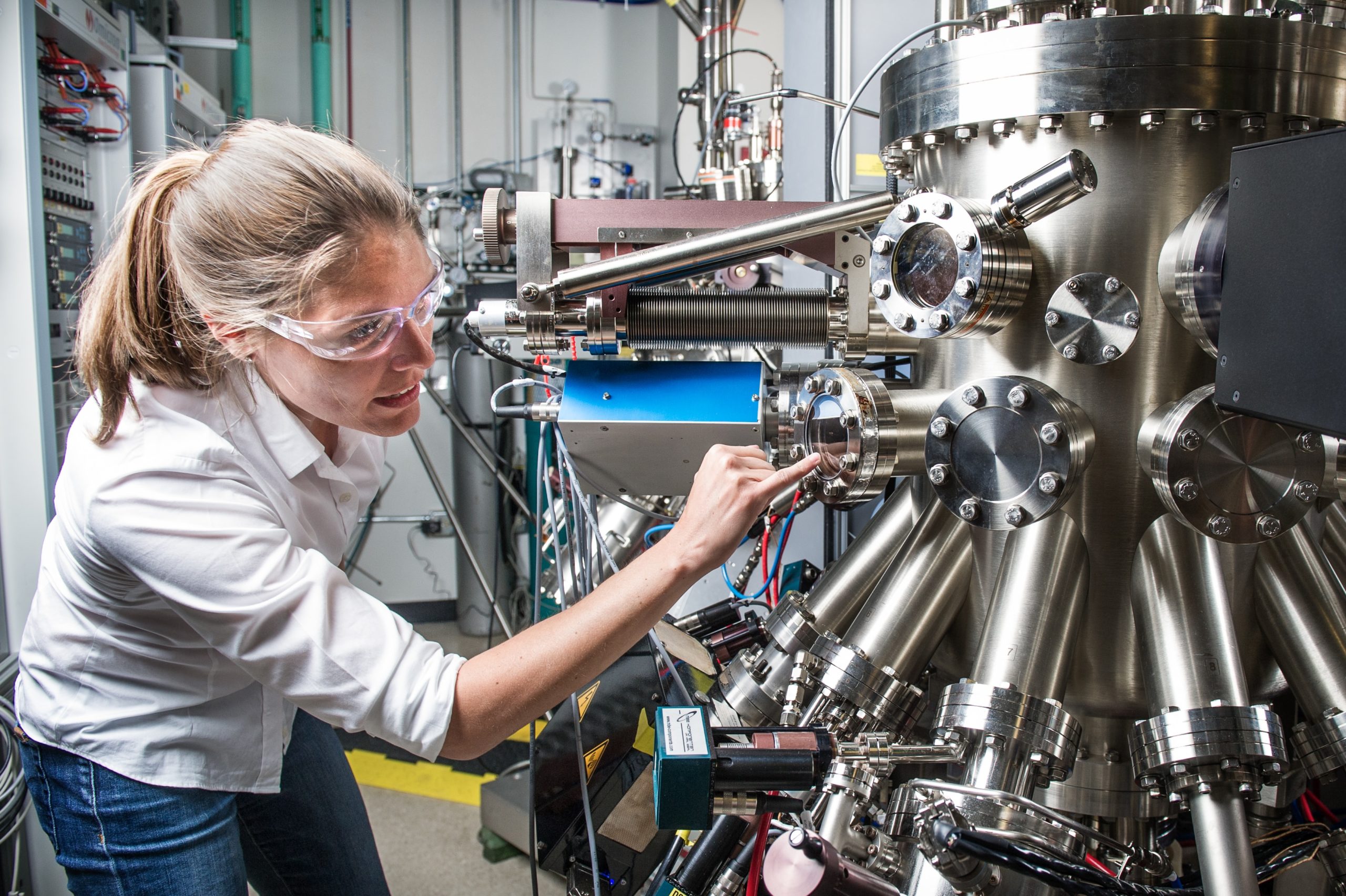

Innovation-based industries are subject to a significant number of market failures, including externalities, network failures, system interdependencies, and the public-goods nature of technology platforms. For example, companies investing in research, on average, capture less than half the returns from that research, even with robust intellectual property protection. The other benefits go to consumers and competitors. This means, absent policies such as an R&D tax credit or pre-competitive R&D grants, companies will underinvest in research relative to the level that would maximize economy-wide returns.

Moreover, the divergence between public and private returns from investments in innovation means that it is actually government that can best “pick winners.”Consider two technologies: one that provides business with a rate of return (ROR) of 20 percent and no spillovers to society, for a societal ROR of 20 percent; and another that provides business with a 10 percent return and spillovers that generate a societal ROR of 30 percent. Market forces will target capital to the former and business will undervest in the latter, thereby reducing overall growth. This does not of course mean government ownership of the means of production or heavy-handed government direction. Can we stop raising this canard? Nor does it mean that forward-looking corporate management with companies investing for long-term profit maximization are not critical to American success. Of course they are. But it does mean that absent robust government industrial and technology policies, that America will underperform our competitors, especially nations like China which is pouring hundreds of billions of dollars in support advanced industries.

This does not mean, as the skeptics will continue to cry, moving to “Soviet Gosplan” or “crony capitalism.” No, as the essays in “Rebooting the American System” show, the U.S. government has a long and proud tradition of “picking winners.” And multiple agencies today, including DOD’s DARPA, DOE’s ARPA-E and NIH, successfully identify and support technological innovations critical to our nation’s future. It’s time to recognize that and extend that support beyond national missions of defense, energy and health and make commercial competitive success against China a core national mission. If we don’t we can ensure that the market will adapt, leading to even more waste paper and soybean exports to China.

Recommended Reading

No, Adopting an Industrial Policy Doesn’t Mean We’re Emulating China

There is a continuum of state involvement in industry and technology policy that spans from doing nothing to picking particular firms and technologies.

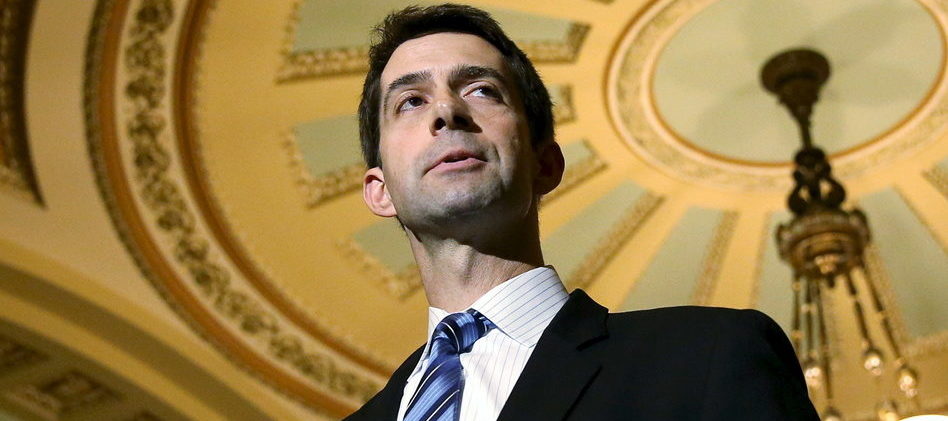

America Cottons on to Industrial Policy Again

Recently, I suggested that the United States would do well to emulate some aspects of China’s economic development model, largely on the grounds that this still constituted the optimal route to reindustrialization. If done correctly, reindustrialization can provide a key means of generating high quality jobs in the U.S. and a corresponding break from today’s prevailing market fundamentalist model characterized by precarious employment prospects, wage stagnation and the loss of many of the attributes long associated with a prosperous and stable middle class.

Are British Conservatives Providing a Future Template for Post-Trump Republicans?

Much as the Brexit referendum anticipated the rise of the Trump presidency, the current UK Conservative government led by Prime Minister Boris Johnson may now be providing clues as to a possible future path for the post-Trump Republican Party in the United States.