Pre-competitive research consortia are vital to sparking innovation.

RECOMMENDED READING

More than a decade ago, I pointed out the critical need to restore American manufacturing capabilities that had withered away.1Gary Pisano and Willy Shih, “Restoring American Competitiveness,” Harvard Business Review 87, nos. 7/8 (2009). The COVID-19 pandemic has exposed how lost capabilities have impaired our nation’s ability to manufacture critical healthcare supplies, pharmaceuticals, and medical equipment, as well as our dependence on interruptible foreign sources for everything from telecommunications equipment to auto parts.

We should harness the lessons learned from the crisis to take stock of our manufacturing capabilities and rebuild them in critical areas. While we can’t expect to manufacture everything ourselves, leadership in critical areas can ensure greater resilience during the next crisis and greater competitiveness for the geo-economic challenges ahead. In that spirit, I propose two key ideas for American policymakers: focus on the demand side of the equation, and foster and fund more pre-competitive partnerships.

Focus on the Demand Side

Most prescriptions for rebuilding American manufacturing focus on the supply side, incenting manufacturers to move production to the U.S. and then potentially erecting trade barriers to protect resulting higher-cost positions. A more sustainable approach would be to focus on the demand side, growing domestic demand in early markets for new technologies as a way of incenting the growth of local supply.

If we look historically at industries in which the U.S. has led—automobiles in the 1920s, computers, telecommunications, integrated circuits (ICs), the Internet, products using the global positioning system (GPS)—large early markets drove consumption and gave American firms incentives to innovate. Often, as was the case for ICs and GPS, it was the U.S. military or the space program. A recent example is NASA and the Air Force securing long-term contracts with SpaceX to deliver payloads to orbit—including Crew Dragon in May—and providing cash flow for the company to develop innovations like reusable vehicles that have changed the game in space launch.

Demand provides economic motivation to manufacturers, and proximity to production is valuable for early-stage products for which dominant designs haven’t emerged. Close interactions between product developers, manufacturers, and consumers facilitate rapid iterations and product refinements. Having a large home market in which to “practice” is also a significant advantage. As long as consumers will buy interim products as the manufacturer improves its production processes, demand can generate the cash a firm needs to grow, learn, and improve. A large domestic market served the United States well during the twentieth century, and it is now a substantial advantage for Chinese manufacturers.

Foster and Fund Pre-Competitive R&D

Much has been written about the economic benefits of public funding of basic research.2See: K.J. Arrow, “Economic Welfare and the Allocation of Resources for Invention,” in Readings in Industrial Economics (London: Palgrave, 1972), 219-236; N. Rosenberg, “Why Do Firms Do Basic Research (With Their Own Money)?” in Studies On Science And The Innovation Process: Selected Works of Nathan Rosenberg (2010), 225-234; National Innovation Systems: A Comparative Analysis, ed. R.R. Nelson, (New York: Oxford University Press, 1993); R. R. Nelson, “Why Should Managers Be Thinking about Technology Policy?” Strategic Management Journal 16, no. 8 (1995); OECD Science, Technology and Industry Outlook 2008, Organisation for Economic Co-operation and Development (OECD); K. Pavitt, “What Makes Basic Research Economically Useful?” Research Policy 20, no. 2 (1991); K. Pavitt, “The Social Shaping of the National Science Base,” Research Policy 27, no. 8 (1998); A.J. Salter and B.R. Martin, “The Economic Benefits of Publicly Funded Basic Research: A Critical Review,” Research Policy 30, no. 3 (2001). American strength in sectors like life sciences and biotech, materials, computing, communications, and aerospace came from public investments in basic research. But in many fields today—especially those at the frontiers of science and technology—investment needs to bring pioneering discoveries to market that are beyond the reach of even the best-funded firms. The U.S. should encourage the formation of more pre-competitive research consortia as a way of helping to commercialize innovations in critical areas to cement global leadership.

In pre-competitive R&D, partners work together on a common technology platform with which they intend to independently develop differentiated downstream products. This pre-competitive model maintains proprietary access to the intellectual property and learning that might result. The obvious benefit is increased research efficiency, increasing scale and scope while reducing duplication through the pooling of resources and capabilities.3J.S. Altshuler et al., “Opening Up to Precompetitive Collaboration,” Science Translational Medicine 2, no. 52 (2010). Participants share knowledge and mitigate risk, leveraging a larger scale and scope of information, resources, and capabilities across firm boundaries. They share lab space, instruments, tools, materials, and all the infrastructure for collaboration. They also share people, and this has the benefit of broadening the pool of ideas. For firms where the incentive to do research may not necessarily be high, being able to tap into a broader knowledge base widens exploratory activities and the development of new ideas.4P. Dasgupta and P.A. David, “Toward a New Economics of Science,” Research Policy 23, no. 5 (1994); R.R.Nelson, “The Simple Economics of Basic Scientific Research,” The Journal of Political Economy 67, no. 3 (1959).

“While we can’t expect to manufacture everything ourselves, leadership in critical areas can ensure greater resilience during the next crisis and greater competitiveness for the geo-economic challenges ahead.”

Two circumstances, in particular, favor such collaborations: when the scale and complexity of R&D needed to remain competitive outpace individual firms’ in-house capabilities, and when the target area for partnering is some distance from downstream product markets, focusing on enabling technologies rather than specific market segments or niches.

An example of such a collaboration was SEMATECH, established in 1987 as a way for U.S.-based semiconductor manufacturers to respond to Japanese competitors. The 14 participants felt that no firm acting on its own could compete effectively, so pooling resources and sharing technology had the potential to increase the effective scale of American industry and to recover market share.5L.D. Browning, “Building Cooperation in a Competitive Industry: SEMATECH and the Semiconductor Industry,” Academy of Management Journal 38, no. 1 (1995). Initial goals included industry infrastructure—especially the capabilities of specialized equipment and materials suppliers—manufacturing processes, and factory management. The founders agreed to contribute in proportion to their revenues for an initial period of five years, and the federal government matched the sum, leading to an overall budget of close to $1 billion. Work initially focused on reducing the feature size of transistors on chips, technology that all of the partners would benefit from and that each could employ to compete in downstream product markets. While SEMATECH has evolved considerably since its founding, the pre-competitive R&D phase cemented U.S. leadership at a crucial time.

A purely commercial example with no government support was the Common Platform Alliance, in which IBM, Siemens, and Toshiba focused on process technology for making advanced semiconductors. Others who were having trouble developing competitive CMOS process technology joined, including Advanced Micro Devices—whose technology operation was spun off and became the base for Global Foundries—Freescale Semiconductor, Infineon, Samsung, ST Microelectronics, and Chartered Semiconductor. The Alliance helped Samsung and Global Foundries develop their respective competitive positions in the industry—especially in the move to high-k metal gate designs around 32 nm. Though the Alliance has wound down and been superseded by collaborative efforts at SUNY Albany, it served the partners well for a number of years, giving them a far better level of process capability than they could have developed alone and at a significantly lower cost.

This type of pre-competitive collaboration is common in Europe. For example, the Interuniversity Microelectronics Centre (IMEC) in Belgium is a world-leading innovation hub in nanoelectronics that counts organizations like DARPA, Intel, and TSMC as partners. The BioPro consortium in Denmark focuses on advanced fermentation-based manufacturing processes of biological compounds, adding to the strength of the fermentation cluster around Copenhagen. The partners’ end-product markets include pharmaceuticals, food ingredients, industrial enzymes, energy production, and hydrocolloids—all distinctly different with minimal overlap. Many such European programs serve narrow market niches and help participants sustain global competitiveness.

“The U.S. should encourage the formation of more pre-competitive research consortia as a way of helping to commercialize innovations in critical areas to cement global leadership.”

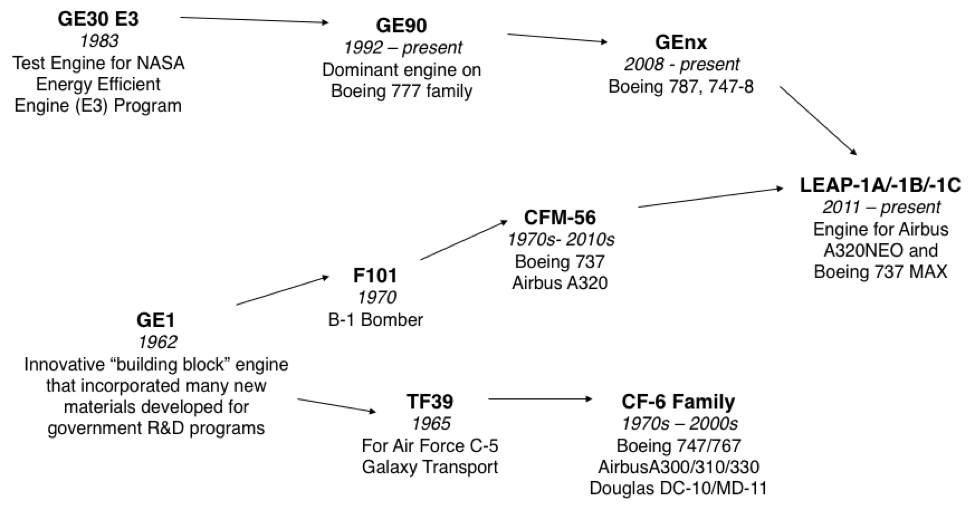

NASA’s Aircraft Energy Efficiency program of the late 1970s offers an outstanding example of the impact of government support for such collaborations.6M. Bowles, “The Apollo of Aeronautics: NASA’s Aircraft Energy Efficiency Program, 1973-1987,” NASA (2010). It came out of a hearing before the Senate Aeronautical and Space Sciences Committee in the wake of the 1973 Arab Oil Embargo, which painted a dire picture of “immediate crisis condition,” “long-range trouble,” and “serious danger.” The program’s objective was to establish enabling technology that aircraft manufacturers could commercialize at their own expense. NASA contracted with Pratt & Whitney and GE to do early-stage research on advanced propulsion systems for subsonic aircraft, with involvement from Boeing, Lockheed, and McDonnell-Douglas. This learning platform proved to be immensely valuable to the companies and U.S. global leadership more broadly. The Experimental Clean Combustor program sponsored early development of the Dual Annular Combustor at GE, which went into the CFM-56 engine, the most commercially successful turbofan engine in history. The Advanced Subsonic Technology (AST) and Ultra Efficient Engine Technology (UEET) Programs helped to advance the basic science and secure long-term global leadership for the U.S. in the large turbofan category. The chart below shows government support for key parts of GE’s product roadmap. The program was pre-competitive research at its best.

GE Aviation Engine Roadmap: Key Technologies

The National Science Foundation reports that R&D expenditures have grown more rapidly in several Asian economies, particularly China, than in the U.S.7B. Kahn et al., “The State of U.S. Science and Engineering 2020,” National Science Foundation (2020). While the U.S. continues to spend the most on R&D of any single country, the share funded by the federal government has declined since 2000. Because businesses are the largest funder of R&D, federal funding for pre-competitive collaborations in important new areas, as in the examples described above, could foster or accelerate the development of important manufacturing capabilities in industries that will be important in the future.

Policy Recommendations

As the COVID-19 pandemic recedes and the country considers infrastructure spending to provide an economic stimulus, federal policymakers should aggressively target some of this spending to generate stable domestic demand for key platform technologies and increase funding of pre-competitive R&D programs aligned with those areas. This will boost the growth of domestic manufacturing capabilities, contributing to longer-term economic sustainability.

Biomanufacturing. The U.S. lead in biotechnology is the product of extensive pre-competitive research sponsorship. Funding for the Human Genome program made possible something that was beyond the means of individual labs and companies, and the interdisciplinary effort mounted at NIH and places like MIT and Harvard, among others, secured this country’s position in the field. Federal funding for places like MIT’s Department of Chemical Engineering developed processes to manufacture biopharmaceuticals. Today, we do this better than any other nation on earth.

The U.S. should extend its position and invest in more precompetitive R&D in biomanufacturing. We could incent the use of a new generation of process-intensified bioreactors to make biopharmaceuticals, and traditional as well as recombinant vaccines. We could develop the demand side by building national strategic stockpiles for key medicines or purchasing vaccines as part of assistance packages to underdeveloped countries. We should look at fermentation-based technologies, engineered microbial cell factories, flexible approaches to purification, and plant-based production concepts. Continuous flow manufacturing, another innovation in chemical processing, might enable us to deploy new lower-cost process technology, not only rendering existing competitors’ installed capacity obsolete but also making the U.S. small molecule generic drug supply chain far more resilient. DARPA has taken this approach with its Battlefield Medicine program by funding the development of flexible miniaturized manufacturing platforms and methods for producing multiple small-molecule APIs from shelf-stable precursors in order to meet specific medical needs as they arise.8K. Duggan, “Battlefield Medicine,” Defense Advanced Research Projects Agency. Driving the domestic commercialization and adoption of such technologies with favorable tax treatments or incentives would be a great way to lessen future dependencies while building up strategic capabilities in the sector.

“A strategic effort to invest in pre-competitive R&D should be a top priority for the United States. Our future competitiveness may depend on it.”

Grid Modernization. Another good target for federal spending is electrical grid modernization, a known strategic vulnerability. This is already part of a Department of Energy initiative, and funding to speed implementation would support the transition to a distributed generation architecture better suited to renewables technologies. It would drive domestic consumption of power semiconductors and the development of microgrids, sensing technologies, and high-voltage DC transmission systems, as well as new services.92018 Grid Modernization Initiative Peer Review, U.S. Department of Energy (2020). Similarly, funding for interconnecting the three major U.S. grids10The U.S. has three major grids, the Eastern Interconnect, Western Interconnect, and Texas with its own grid. Equipment at the connection points is nearing the end of its useful life. Because demand peaks occur later in the West, a national grid would offer better demand sharing and peak load management, and could make more effective use of wind and solar generation in the west. could drive the replacement of equipment that is more than 40 years old and encourage substantial energy- and operating-reserve sharing.11D. Wagman, D, “It’s Time to Tie the U.S. Electric Grid Together, Says NREL Study,” IEEE Spectrum (2018). Domestic content rules for equipment or tax abatements would also drive domestic capability development.

As policymakers consider other sectors for investment, they should be forward-looking and identify “platform” technologies that will underpin innovations in a broad range of products and services. Examples might include secure communications (especially millimeter wave, 6G technology), high-performance materials (e.g., high-temperature superalloys and composite materials), next-generation semiconductor technology (e.g., chiplets, heterogeneous integration, advanced photonics, and new materials like Group III-V), energy storage technology, next-generation architectures to support artificial intelligence and new computational applications, and genomics-based medicine. Policymakers should also convene leaders in the scientific community to advise government efforts and take a portfolio approach to public investments, recognizing that some failures are inevitable and that it will not be possible to predict everything.

Pre-Competitive Program Design Considerations

Pre-competitive R&D consortia need to include leading companies, universities, and government research labs that are working at the frontiers of technology. This is not to exclude some firms; the intent of such collaborations should be to advance the frontier on commercialization, not act as a training ground for developing base capabilities. That should be the work of other types of partnerships.

While some companies form alliances and joint ventures, many shy away from activities that are too close to commercialization due to risks associated with antitrust or competition laws.12R. Gulati, “Alliances and Networks,” Strategic Management Journal 19, no. 4 (1998); T. Khanna et al., “The Dynamics of Learning Alliances: Competition, Cooperation, and Relative Scope,” Strategic Management Journal 19, no. 3 (1998); D.C. Mowery, “Strategic Alliances and Interfirm Knowledge Transfer,” Strategic Management Journal 17 (S2) (1996). The core question is the antitrust treatment of research joint ventures. The Senate Judiciary Committee noted in a 1984 investigation that antitrust challenges have “been frequently cited by industry to explain the reluctance to undertake such activity.”13G.M. Grossman and C. Shapiro, “Research Joint Ventures: An Antitrust Analysis,” Journal of Law Economics, and Organization 2, no. 2 (1986). The National Cooperative Research Act of 1984 was designed to reduce this risk for research joint ventures and standards organizations. What about pre-competitive collaborations that target the shared development of a supply base? For example, the Institute for Advanced Composites Manufacturing Innovation (IACMI) is focused on energy-efficient manufacturing of polymer composites. Such initiatives could be looked at as a form of buying cooperative and thus could have been treated as a group boycott and subject to per se invalidity under the Sherman Antitrust Act (e.g., United States v. Gen. Motors Corp., 384 U.S. 127, 145 (1966)). But U.S. courts have looked more broadly at effects on markets and whether a particular initiative seemed designed to increase economic efficiency and render markets more, not less competitive. IACMI, if successful, would foster substitution of advanced composites for traditional materials and easily meet that test.

Our Future Depends on Investments We Make Today

Restoring manufacturing capabilities in the United States will require many steps taken by the private- and public-sector in concert. Doing so will be critical not only for ensuring the nation’s economic resilience, but also for securing its technological supremacy going forward. Policymakers and industry practitioners have been right to focus on supply-side solutions, but they should not ignore the demand-side factors necessary to motivate manufacturers and foster long-term sustainable competitive positions. A strategic effort to invest in pre-competitive R&D should be a top priority for the United States. Our future competitiveness may depend on it.

Recommended Reading

Intel’s Stumble is Very Bad for America

America used to dominate the semiconductor industry, but that leadership position is increasingly fragile. There are two parallel forces at work: the rise of our competitors and the decline of our domestic champions.

A Guide to the Semiconductor Industry

A guide to what is happening in the semiconductor industry and how the U.S. fell behind its competitors in the global race for leadership.

American Compass on CHIPS Act Passage: An Inflection Point in U.S. Policy

PRESS RELEASE—America is finally getting serious about returning critical industries to our shores.