RECOMMENDED READING

The basic motivation behind American Compass’s Coin-Flip Capitalism project seems to be scrutinizing the private fund industry—an industry that is indeed poorly understood by most—under the suspicion that, amidst its mysteries and its trillions, it may be detracting from our national welfare. Fair enough.

But as a long-time participant in the industry, and even more so as someone dedicated to U.S. national security, I see serious analytical flaws and even more serious geostrategic flaws which I think detract from the substance and the spirit of Coin-Flip Capitalism, leading it off track when there are more important issues in American political economy that deserve urgent and sustained attention.

Private Funds Do in Fact Outperform Public Markets on Average and on a Risk-Adjusted Basis

The analytical centerpiece of Coin-Flip Capitalism is the “Returns Counter.” It seeks to show that the returns of some of the most important sub-segments of the private fund industry (hedge funds, buyout private equity funds, and venture capital funds) have often produced investment returns that are lower than public equity markets—the explicit implication being that if they fail to beat the public markets, these various types of funds are clearly not creating “economic value” as they claim (and, worse, they “collect their fees regardless”).

The issue with this is that the conclusion is not correct.

To see why consider that the base year chosen to compare public equity and private fund returns in the Returns Counter is 2009. The author, Wells King, may have chosen 2009 in good faith and out of convenience, as this is in fact the year one lands on when looking at the latest 10 years of returns from early 2020. But from the perspective of someone actively involved in finance, this choice raises serious red flags. In 2009 public equity markets hit their panic-induced, financial-crisis lows, whereas private fund investments were valued (then like any other time) at or near book or other marked value (i.e. generally not at equivalently depressed values). Thus, public equity returns going forward from a year like 2009 will always look “artificially” inflated in comparison.

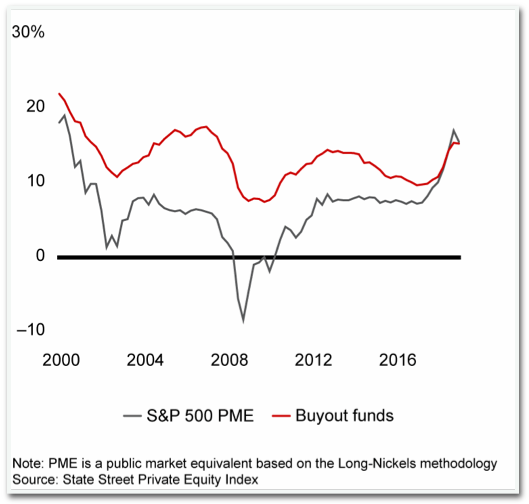

The proper analytical approach, by contrast, is to compare public and private returns across different base years to avoid being misled by outliers. Doing so (see chart below) shows clearly that buyout funds have significantly outperformed public markets on a rolling 10-year basis since 2000, except for a convergence beginning in 2018-2019, precisely 10 years after the financial crisis. Similar analyses for venture capital show that venture capital funds outperform public markets over time.

It is true that hedge funds, by contrast, have underperformed public markets on average. But Coin-Flip Capitalism fails to adequately emphasize that this is precisely the expected result. For example, the long-term return capital markets assumptions used by Cambridge Associates, perhaps the most well-regarded institutional investment advisory firm, is an expected return of 6.1% for hedge funds, significantly lower than their expected 7.5% for global equities. While hedge funds have a huge variety of strategies with different risk-adjusted return goals (some are intended to beat the public markets), in general, they are designed to hedge against downward market movements—which comes at the expense of capturing the full market upside. Asset allocators measure hedge fund performance not versus a general public benchmark, but in risk-adjusted terms that are tuned to reflect how much risk each specific strategy seeks to take.

Thus, in the end, the punchline of Coin-Flip Capitalism fails to convince. Private funds in all three categories have long outperformed public markets on a risk-adjusted basis. But in my view, such analytical quibbles, however important at getting an accurate understanding of the private fund industry, miss a much more important point.

The Private Fund Industry Is a Significant Source of Comprehensive U.S. National Power

Viewed comparatively, the fact that the United States has a robust private fund industry is a major competitive advantage and source of comprehensive national power.

To see why, it’s important to understand that the private fund industry is, in essence, a professionalized and organized mechanism of allocating capital into (and out of) small and/or new firms.1Hedge funds are an exception to this, which I view as organized means of utilizing derivatives in commingled trading strategies. While hedge funds can claim little credit for helping small firms, they can claim significant credit for fostering liquidity and price transparency in U.S. capital markets, an unrelated but also substantial benefit. The industry emerged in the 1940s and 1950s pioneered by investors such as Laurance Rockefeller2For a good history of the industry, see: Tom Nicholas, VC: An American History (Cambridge: Harvard University Press, 2019).

and arose as an alternative to old-style merchant banking and informal, unprofessional family investors.3Joseph Wechsberg, The Merchant Bankers, (Pocket Books, 1968).

Almost all other regions around the world lack mature and well-functioning private fund industries. In developed market economies like Europe and Japan, state-financed and -controlled venture investment, seeking to emulate American successes, is notoriously corrupt and ineffective, and small firms rely on networks of relatively inefficient and inaccessible bank finance. In China, mercantilist, state-directed finance is monopolized by inefficient, state-owned companies, and private equity and venture funds are only free to pursue opportunities in the small and shrinking “new economy” where the state-owned companies don’t bother to exert their dominion.4Nicholas R. Lardy, The State Strikes Back: The End of Economic Reform in China? (Petersen Institute of International Economics, 2019).

In Latin America, South Korea, and Russia, oligopolistic families and/or state-owned groups not only effectively monopolize all meaningful finance, but often use the levers of state to make sure that innovative new firms either cannot survive or are coercively transferred into government or government-linked, clientelistic ownership and/or control (see the saga of Yandex in Russia, for example).

In the U.S., the companies and securities controlled by the private fund industry occupy a small corner of the economy, representing in aggregate less than 10% of financial assets and 7% of employment. But couched in a U.S. environment with strong rule of law and functioning markets, the funds are able (and incentivized) to professionally allocate capital to small firms for which bank finance, corporate investment, and/or public securities are either not available or not advantageous options.5Readers may wonder how buyouts worth billions of dollars can be considered “small”, but should keep in mind that (a) the average buyout deal size of about $2 billion is significantly smaller than the median enterprise value of companies in the S&P 500 of $33 billion, and (b) private funds invest everywhere from newly formed companies to buyouts, covering the entire spectrum of small and medium sized (SME) companies. In alliance with other sectors such as government- and academically-funded scientific research institutions, private funds have served effectively as tutors to companies pursuing American innovation in absolutely foundational areas such as semiconductors (Intel) and information technology (Apple, Google) as well as contributors to the depth and breadth of U.S. capital markets, lowering our national cost of capital and helping to ensure that the dollar maintains its privileged status as the primary global reserve currency. Viewed in a comparative and historical perspective, it is not an exaggeration to say that the private fund industry has been one of the primary enabling sources of American comprehensive national power over the last 70 years, having transformed small company finance from the province of half-baked club deals or matters of oligopolistic or mercantilist activity into a serious, market-driven institution that has produced manifest results.

The private fund industry in the U.S. nevertheless does have serious problems. These include misalignments of interest between fund managers and investors and a high bankruptcy rate among buyout funds’ portfolio companies due to their utilization of very high leverage, among others.

But set against the entire American economy, these problems are a sideshow. The real story in American political economy today is the decline of the long-term rate of return on capital.6L. H. Summers and Ł. Rachel “On Falling Neutral Real Rates, Fiscal Policy, and the Risk of Secular Stagnation,” Brookings Papers on Economic Activity Conference Drafts (2019), 1–68. This is in fact a contributing factor to some of the issues in the private fund industry, such as increasingly high leverage used to maintain returns. But the basic causes of the falling real rate seem to be declining workforce growth, persistently low productivity growth, depressed aggregate demand, and other bedrock economic factors which do not find their origins in private funds, but rather in a neoliberal trading régime that has granted U.S. firms a free pass to export labor and environmental externalities while eviscerating U.S. labor bargaining power for the last forty years, alongside staggering price inflation in the quasi-market education and healthcare sectors.

Attempting to “fix” the issues in the private fund industry runs a real risk of doing more harm than good by potentially hobbling a unique U.S. industry with a robust track record of positive national (and global) contributions while diverting scarce public and policy attention from much larger, more serious, and urgent challenges. Particularly for those concerned with the welfare of American labor, the rehabilitation of American manufacturing, and the future of American national competitiveness in a hostile world, the private fund industry should be viewed as an ally and prized asset whose incentives are capable of being channeled by the Congress and White House away from some of the mistakes of the neoliberal past and toward a vibrant and externality-minimized market economy capable of ensuring a bright future for all Americans.

Recommended Reading

Private Equity, Hedge Funds Get Unlikely Foe in GOP Think Tank

American Compass’s first special project, “Coin-Flip Capitalism,” was featured by Bloomberg Politics, challenging established economic views on the right.

Coin-Flip Capitalism: Q3 2020 Update

Commentary on developments in private finance and the Coin-Flip Capitalism debate as of Q3 2020

Populists Don’t Know Much About Private Equity

Responding to the Coin-Flip Capitalism project, University of Chicago Professors M. Todd Henderson and Steven Kaplan say to leave investors out of it: the fees to fund managers prove the social value.