Founder’s Letter

By Oren Cass

This year marked the centennial of W. B. Yeats’s “The Second Coming” and the line “Things fall apart; the centre cannot hold.” I am no poetry buff. There are probably only two or three poems, all by Robert Frost, from which I could recite a single stanza. But that snippet from Yeats pops frequently into my mind because it describes so well the most interesting developments in our world. Things—all things—do eventually fall apart. Conditions change; knowledge expands; behaviors, beliefs, and relationships evolve; and a center squarely established at one moment in time cannot hold in another. The trajectories of individual lives, large institutions, and entire nations and civilizations are defined by what follows.

America’s center is not holding. The issue is not any particular election result, or the happenstance of a global pandemic, but the expiration of the neoliberal political consensus and policy agenda that has characterized recent decades, with its globalization, deregulation, and financialization of the economy; atomization of the society; and reliance on redistribution to those left behind. The challenge manifests in symptoms ranging from the concentration of wealth in fewer hands and of growth in narrow geographies, rising “deaths of despair” and political dysfunction, declines in family and community well-being, and a stalling out of the investment and innovation that generate productivity growth and rising wages. All have contributed to what the American Enterprise Institute’s Nicholas Eberstadt has termed “Our Miserable 21st Century.”

For Yeats, what follows is “mere anarchy … loosed upon the world.” We can do better. The ability to avoid that fate is among the great virtues of our capitalist economy and republican system of government. The leaders of our institutions, by design, have incentives to detect and respond to change, and those institutions have the capacity to adapt. We ensure that prospective competitors can enter our markets, our civil society, and our politics, so that entrenched incumbents face constant pressure—and when some do snap rather than bend, replacements stand ready to fill the void.

In the popular imagination, this process happens automatically, as if by magic. Adam Smith’s unfortunate metaphor of an “invisible hand.”

2020 Year in Review

One year ago, on December 19, 2019, American Compass incorporated. Two months later, we publicly announced our formation and published an initial statement of principles in National Review, titled “The Return of Conservative Economics.” That same week, we received feature coverage everywhere from the Washington Post to the Daily Caller to the Claremont Institute’s American Mind podcast. Oren Cass appeared on Tucker Carlson Tonight, presented to Harvey Mansfield’s seminar at Harvard, and discussed the future of conservatism on the Realignment podcast.

“I am optimistic that the winds are changing, with organizations like American Compass already proving essential in the process of charting the right course.”

—Senator Marco Rubio

By the end of March, the Wall Street Journal editorial page had produced a video attacking us, and Senator Pat Toomey had delivered a speech at the Heritage Foundation warning that we were “a dagger thrust into the heart of the traditional center-right consensus.” Rep. Dan Crenshaw hosted Oren on his podcast and agreed that “adherence to dogmatic market-decision-only policy … may not be pushing our country in the direction that we need to be pushed in.” The Ronald Reagan Institute hosted Oren on the Reaganism podcast, during which the host noted: “You are, no doubt, making an impact, having influence and, in some respects, driving people crazy.”

“Groups like American Compass can equip us with the policy to win our independence in a dangerous world, a task that cannot be outsourced to anyone else. We must do it for ourselves.”

—Senator Tom Cotton

Our formal launch came on May 4, when we released our first collection, Rebooting the American System: The Comprehensive, Conservative Case for Robust National Economic Policy, featuring forewords from Senators Marco Rubio and Tom Cotton. Senator Josh Hawley welcomed our “bold, and much needed, new venture,” and Senator Mitt Romney expressed how glad he was to have us “helping conservatives rethink how we apply our principles to the problems of today.” The Economist called us “an impressive organisation of [a] dissident faction” and noted that “politics does seem to be moving towards the dissidents.”

“American Compass aspires to be the tool with which future conservative leaders can guide the American ship of state. Those men and women ignore it at their peril.”

—Henry Olsen, Washington Post

In the Washington Post, Henry Olsen wrote: “Martin Luther started the Protestant Reformation by reportedly nailing 95 theological theses to the door of Wittenberg’s church. The website of Oren Cass’s new think tank, American Compass, could be the start of a similar, long-overdue Conservative Reformation.” And at National Review, Yuval Levin said of our inaugural collection:

I find these pieces very valuable not because I agree with them—I certainly agree with some of what they say, but also disagree with quite a bit. I think they’re useful because they elevate the substance and the form of the right’s internal arguments and make it easier to understand what we are disagreeing about. They can’t be answered with snide ad hominem dismissals, and so they stand a chance of inviting responses that further refine and elevate our thinking about the future.

The six months since have been a whirlwind and quickly established American Compass as among the most innovative and influential institutions on the policy scene.

The closely contested presidential election and emergence of a multiracial, working-class base of support within the Republican Party drove even more interest in our work, with more than 200,000 people reading a summary of our recent work on social media.

Conservative Flagship

We launched American Compass for a simple reason: to fill a critical void.

Despite the many serious challenges America faces, the dramatic transformations its economy has undergone, and the once-in-a-generation political realignment under way, the right-of-center’s mainstream institutions were uniformly committed to outdated ideas that long ago ossified into market-fundamentalist dogma. The attitude toward President Trump was “this too shall pass,” and the political aspiration was to return everything to how it was before. With the future of post-Trump conservatism at stake, we needed an institution to step forward with new ideas and foster debates that entrenched groups were more comfortable avoiding.

Still in its first year, American Compass is already recognized as the flagship for a healthier and more responsive post-Trump conservative movement, underscoring not only the void’s size and importance but our effectiveness in filling it.

When David Brooks wrote his August cover story for the New York Times Sunday Review asking the question, “Where do Republicans go from here?” the first place he turned to in describing “a new Working-Class Republicanism” was American Compass.

Likewise, when the Wall Street Journal’s executive Washington editor, Gerald Seib, wrote a feature Saturday essay on “how Trump has changed the Republicans,” he described our project as “new-wave conservatism,” aimed at moving beyond the right’s “tendency to fall back on the view that market forces and a light government hand automatically offer the best answers.” On the heels of the Journal essay, NPR invited Seib and Cass to further expand on the topic during an in-depth, hour-long discussion.

In a long, deeply reported essay in The New Yorker on the post-Trump future of the Republican Party, Nicholas Lemann explored three paths that the right could pursue and described American Compass as the leader in formulating policies that will appeal to a realigned conservative base.

Vox cofounder Ezra Klein, who hosts a wide variety of high-profile guests on his weekly podcast, invited Oren this summer to discuss what a post-Trump GOP might look like, highlighting the ways in which conservatives need to challenge free-market economic orthodoxy.

Increasingly, media outlets, political offices, and think tanks are collaborating closely with us. Both CNN and the Financial Times have invited Oren to be a regular contributor. Senators Rubio, Hawley, and Cotton have collaborated with us through many channels, including our inaugural collection, an open letter, and a live event. When the Republican Study Committee, the largest caucus of conservatives in the House of Representatives, released its American Worker Task Force report, it led with introductory commentary on our blog, The Commons.

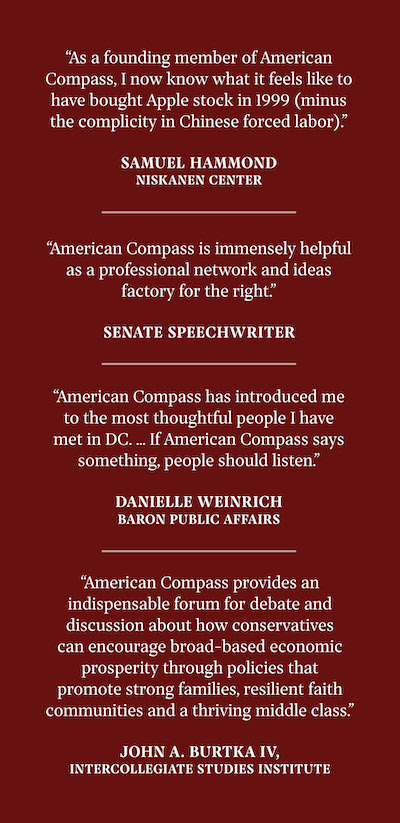

Leaders from the American Principles Project, the American Economic Liberties Project, the American Enterprise Institute, the Institute for Family Studies, and the R Street Institute have cosigned our statements, and scholars from some of those institutions, as well as the Hudson Institute, the Ethics and Public Policy Center, the Niskanen Center, Cardus, the Walton Family Foundation, and the Center for American Progress have published with us. Some individuals at these organizations have sought us out unprompted, seeing us as the ideal platform for their heterodox views. This growing reach positions us well to shape the public debate in the months and years to come.

Changing the Debate

We use our platform to publish collections of research and commentary that prompt debates and force rethinking of stale orthodoxies.

Each collection brings together leading experts and original research in a variety of formats to focus on a particular issue. Without fail, the result has been to bring into the spotlight questions that were once taboo or else relegated to the fringes of conservative discussions.

Moving the Chains, our symposium on reshoring supply chains, received widespread attention on Capitol Hill and within the Trump administration, as well as feature coverage in the Washington Post. Subsequent work at American Compass was featured by Senator Tom Cotton in his push to advance the American Foundries Act, which was ultimately added to the National Defense Authorization Act on a 96–4 vote in the Senate. In the House, Harvard Business School professor Willy Shih’s contribution to the symposium led to his testimony before the House Budget Committee.

In September, we sparked a national conversation about the future of organized labor—and why conservatives can, and should, lead the American labor movement back from obscurity. Our statement on a conservative future for labor earned signatures from a broad group of prominent conservatives, including Senator Marco Rubio, former Attorney General Jeff Sessions, author J. D. Vance, and the American Enterprise Institute’s Yuval Levin. Outlets across the political spectrum—including the New York Times, the Wall Street Journal, Fox News, USA Today, National Review, New York Magazine, and Public Discourse—featured the project, noting that some of the most promising movement on labor is coming from the right-of-center. Offices in both the House and Senate have expressed interest in advancing legislation.

Our projects on Coin-Flip Capitalism and Corporate Actual Responsibility, meanwhile, have initiated long-overdue scrutiny from the right-of-center about how well our market economy channels profit-seeking toward productive ends. Feature coverage of our work at Bloomberg and responses in both the New York Times and Wall Street Journal led to further debates on The Commons and at Newsweek. Oren was also invited to contribute commentary to the special New York Times Magazine feature on the 50th anniversary of Milton Friedman’s famous “shareholder primacy” essay and to appear alongside the Business Roundtable’s executive vice president for policy at the Institute of International Finance’s annual meeting. He has also participated in debates hosted by the Intercollegiate Studies Institute on free trade and with Duke University’s Michael Munger on industrial policy.

For the first time in decades, American conservatives are paying attention to questions like these.

Creating Community

While launching amid a pandemic presented some obstacles to in-person gatherings, our efforts to build a community of like-minded young professionals have been a great success.

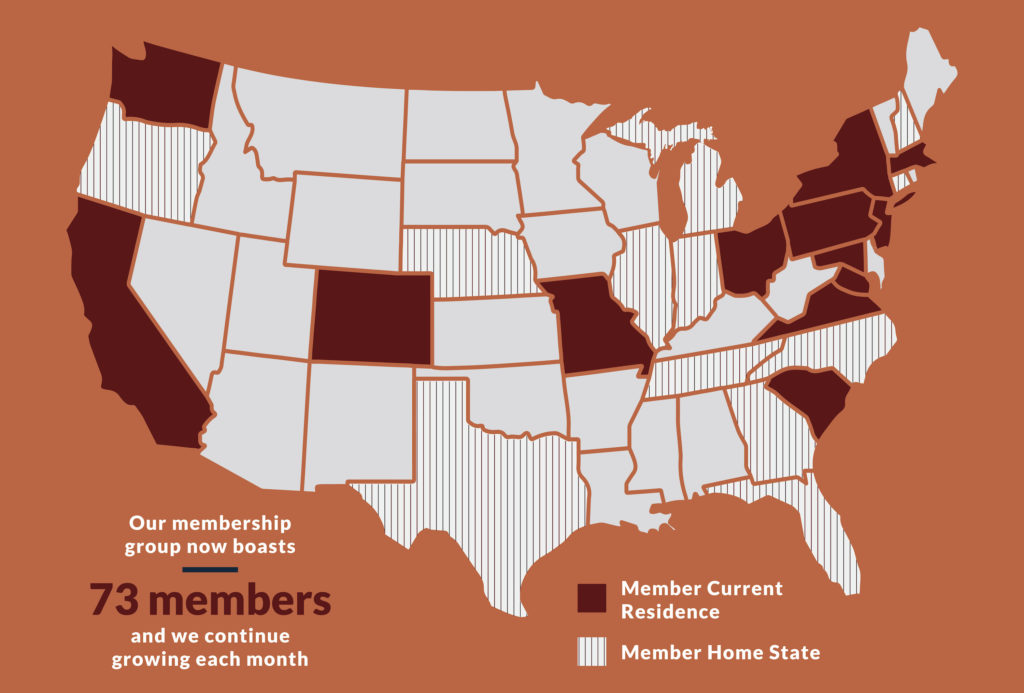

Although most members are based in Washington, D.C., our network is quickly expanding outside the Beltway into cities such as Boston, Denver, New York, Seattle, San Francisco, and St. Louis. Members come from a wide variety of backgrounds and work at more than 20 different publications and Hill offices, in the White House and various government agencies, and at most of the leading conservative think tanks.

Thus far, we’ve hosted virtual events on topics ranging from foreign policy to big tech, convened small social gatherings in Washington, and launched a book club. Members have also contributed to The Commons and the American Compass podcast, sought job applicants and pursued job opportunities, and made new friends.

The Commons

In the spirit of the open debate we hope to foster, our blog, The Commons, is home to a wide variety of perspectives from an extraordinary group of thinkers who span the political spectrum. As its name suggests, The Commons is something of a town square: we welcome civil disagreements and have been delighted to publish several pieces critical of our own work. Our contributing writers debate among themselves, and sometimes these debates escape our walls.

Most recently, Conservative Partnership Institute’s Rachel Bovard and our research director, Wells King, published an exchange on suburban zoning that was taken up by The American Conservative. On trade policy, Oren used The Commons to respond to a Washington Post column by Tufts University professor Daniel Drezner, which began a back-and-forth between the two over the question of how the U.S. should approach its global trading partners. Meanwhile, the Niskanen Center’s Ed Dolan and Samuel Hammond engaged in an exchange with Oren about how the right-of-center should approach welfare policy, redistribution, and “social insurance.”

The Commons is quickly becoming a forum that established writers and scholars seek out as a home for their work. Members of Congress, too, have begun publishing with us, including Senator Marco Rubio and Rep. Ted Budd of the Republican Study Committee, the largest caucus of conservatives in the House of Representatives.

To learn more about American Compass’s work, download the full Annual Report or visit our Issues & Proposals.

Help us build a strong foundation.

When we formed American Compass, we knew that the standard base of financial support for right-of-center organizations might not be available to us because of our willingness to question ideas that have long since become stale dogma.

For this reason, an active part of our project is developing a network of people and institutions who are committed to a healthy conservatism and a strong nation.

We hope you’ll join us in that cause.

How to Support American Compass

You can donate to American Compass via check, wire, stock transfer, or online at americancompass.org/donate.