Commentators and policy analysts respond to our analysis of globalization and proposals to restore balance to the American economy

RECOMMENDED READING

After publishing our latest collection, Regaining Our Balance: Righting the Wrongs of Globalization, we invited a range of commentators and policy analysts to offer their own critiques, insights, and modifications. This page will feature an expanding set of arguments over the coming week.

- Modern Economics Is Not An Illuminati Conspiracy | Stan Veuger (AEI)

- America Should Use Existing Tools, Not Fashion New Ones | Simon Lester (China Trade Monitor)

- Just Say No to Rejoining TPP | Amb. Robert Lighthizer (Former U.S. Trade Representative)

- Free Trade Isn’t Always Better | Ron Hira (Howard University)

- It’s Time for a Neoclassical Economic Reckoning | Jonathan Askonas (Catholic University of America)

- Why the Free Trade Debate Needs the Real Adam Smith | Paul Winfree (Heritage Foundation)

- Did Globalization Cause the Great Stagnation? | Caleb Watney (Institute for Progress)

- How to Bound the American Market | Michael Stumo (Coalition for a Prosperous America)

- Globalists Finally See Reality | Clyde Prestowitz (Economic Strategy Institute)

- What Conservative Critics of Globalization Miss | Anthea Roberts & Nicolas Lamp (Australian National University & Queen’s University)

Modern Economics Is Not An Illuminati Conspiracy

Stan Veuger, American Enterprise Institute

I read “Searching for Capitalism in the Wreckage of Globalization” with more frustration than surprise. Oren Cass’s argument consists, roughly speaking, of two parts. The substance of both parts unfortunately reflects a number of fundamental misunderstandings.

The first part of Mr. Cass’s argument is that the entire economics profession has either misread or misinterpreted a sentence in Adam Smith’s An Inquiry into the Nature and Causes of the Wealth of Nations, and that it has built the case for free trade from that alleged misreading or misrepresentation. This is simply and fundamentally not true.

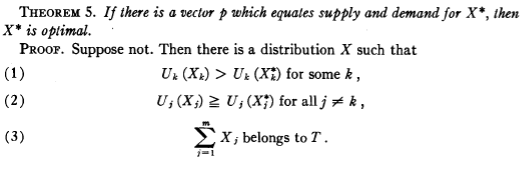

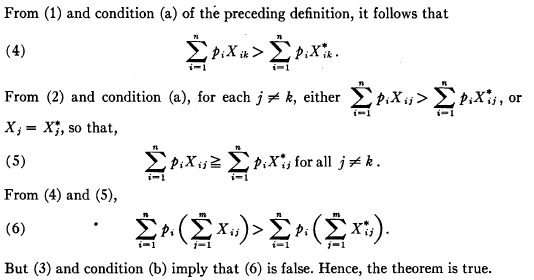

Modern economic theory in general, and trade theory in particular, is not built on quotations from 18th-century books. In fact, a typical proof of the first fundamental theorem of welfare economics—the closest thing to a formalization of Smith’s invisible hand—looks as follows:

The thing to note here: No Smith or Ricardo quotes to support the optimality of the free-market equilibrium. The role their works play for modern economists is that of sources of both inspiration (rarely) and rhetorical flourish (more frequently). Now, I agree that history of thought is interesting even in the absence of current applications, but it does highlight how completely unrelated Mr. Cass’s arguments are to the typical modern case for free trade.

(And in fairness to the economics profession, surely you wouldn’t expect mathematicians to master their craft by reading Leibnitz, or biologists by reading Darwin.)

Now, the optimality result above relies on assumptions that may not be realistic. But those assumptions are explicitly spelled out in the article I took the exhibit from, and much modern work in microeconomic and trade theory has gone into exploring the consequences of relaxing them. For example: In the absence of retaliation, a sufficiently small tariff increase starting from a situation of free trade will improve national welfare.

The second part of Mr. Cass’s article then takes the allegedly misread or misrepresented phrase by Smith (“By preferring the support of domestic to that of foreign industry…”), and claims that it not only undermines the case for free trade, but also justifies a system of capital controls. This attempt misses the point on various levels.

First, the typical modern case for free trade does not rely on even the existence of capital or production, and it holds (more trivially, in fact) in a so-called endowment economy.

Second, free movement of capital and labor can lead to even better outcomes than free trade alone, as Ricardo, ironically, understood and explained in a section quoted by Mr. Cass. This can happen through risk-sharing, through learning by importers and exporters, from the ability of workers to find their niche in a foreign land. I say “can,” because of course many people like to live and invest where they were born, surrounded by familiar faces, smells, streets, and sounds. And a system of relatively free movement of capital and labor obviously allows that!

In fact—and this is the third important misunderstanding I was surprised to encounter—a classic result in modern international economics is that investors disproportionately choose to invest in their home countries. This runs counter to the claims in Mr. Cass’s article that capitalists are forced to invest abroad under our regime of relatively free capital flows. To the extent that Smith and Ricardo believed home-bias investment was a necessary requirement for the case for free trade to hold—which again, I would not concede—they need not fret!

Fourth and finally, much of the second half of the article suggests that American capital has fled Ohio for China. In fact, the U.S. net investment position is deeply negative. This means that overseas residents have invested more in the U.S. than U.S. residents have invested overseas—70% of GDP more. If anything, this means that the U.S. capital stock would be smaller under Mr. Cass’s preferred policies, rather than greater, because overseas residents currently finance a good chunk of it. That in turn completely undermines his central argument even if we accept his theoretical premises, which we should not.

As a closing thought, I will say that the substance and tone of the article make me even more concerned than I already was about the national-conservative intellectual climate. Let me explain.

First, on substance: It is worrisome that the national-conservative movement is now so isolated from America’s mainstream intellectual life that its leading thinkers struggle with relatively well-known facts about economics and the economy in the manner highlighted here.

Second, the discovery Mr. Cass thought he had made led him to consider a potential “global conspiracy.” What he thought he had discovered was, so he claimed, “enough to send one searching for the meeting minutes from whichever Illuminati subcommittee had jurisdiction.” This is not a normal response. The normal response would have been to assume he must be missing something, and to read a book on the intellectual history of free trade like Doug Irwin’s Against the Tide (which includes the full quotation Mr. Cass believes to have uncovered, for what it’s worth), or to reach out to someone with advanced training in economics. It is not a normal response, but it is an all too common one.

[Read this on The Commons.] Back to top.

America Should Use Existing Tools, Not Fashion New Ones

Simon Lester, China Trade Monitor

The debate over free trade versus protectionism has been around for hundreds of years, with a level of political prominence that has varied over time. After a relatively quiet period in the post-war era, the modern debate over trade and globalization’s rules and institutions has grown quite contentious. Regaining Our Balance is emblematic of this renewed debate. Unfortunately, as with much of today’s discourse, its essays ignore some of the domestic and international realities of the trading system. If the renewed trade debate is to be productive, there are three areas where a better understanding of the basic facts is required.

First, it is often said that free trade today is “unfettered.” For example, Oren Cass refers to “[t]he entire edifice of globalization—the case for the unfettered flow of goods … .” Similar characterizations have been offered by people on various points of the political spectrum, from Bernie Sanders to President Biden’s U.S. Trade Representative Katherine Tai to President Trump’s U.S. Trade Representative Robert Lighthizer.

But it is difficult to see how the current trading system, either in U.S. law or global rules, can be characterized as “unfettered”; the fetters are abundant. Many products are still subject to basic tariffs, and there is a long list of other trade barriers, including: agriculture subsidies and restrictions, “Buy American” government procurement provisions, the Jones Act, safeguard tariffs, and anti-dumping tariffs (space does not permit a discussion of anti-dumping here, but suffice it to say that as applied, U.S. anti-dumping laws do not target practices that are unfair, but offer yet another form of protectionism for domestic industries).

International trade rules permit such trade barriers, and the United States has negotiated a set of international rules that allow nations to protect their domestic industries within agreed-upon limits. Thus, trade agreements result in mutually agreeable constraints on protectionism rather than “unfettered” free trade.

Second, critics of the current trade system overstate the extent of the power it grants to international institutions. Jeff Sessions says that “binding trading agreements and treaties would shift power from nations to transnational entities controlled by unaccountable bureaucrats.” But governments cannot be forced to comply with these agreements. In fact, the United States and other governments have not complied in some prominent cases, although governments usually do comply because they want others to as well.

Moreover, the power given to international bureaucrats is so small that it can be quite difficult to detect. The only significant trade power held by international organizations is in the context of disputes, where arbitrators who hear disputes that governments bring against each other can offer clarifications of the existing trade rules when issuing their rulings. But international dispute settlement is not like a domestic court, and the governments can decide not to comply with arbitrators’ rulings. Thus, there is little for critics to worry about here.

Outside the context of disputes, international institutions have virtually no power of their own, as governments have full control over decision-making. Sessions has worried about the power of trade institutions such as the “TPP Commission,” and he warned in his essay: “The Trans-Pacific Partnership (and the Trans-Atlantic Partnership that was to follow) was the next big step. As with the European Union, each nation would have one vote.” But this statement turns reality on its head. Trade agreement decision-making requires consensus, such that voting in trade agreements enables any country to block proposals from going forward. Having one vote at the Trans-Pacific Partnership (TPP) would mean that the United States could block any action by the other TPP parties. Rather than surrendering control to an international body, trade agreement voting procedures are about reserving control for member nations.

Third, perhaps the biggest issue in today’s trade debate is one that Cass quotes Mitt Romney as raising: “But what are we going to do about China?” Supporters of the current trading system have an answer, but unfortunately it has largely been a path not taken.

Prior to its entry into the World Trade Organization (WTO) in 2001, China was already rising economically. It had begun a policy of opening up to the world in 1978, and its negotiation for accession to the WTO helped push this liberalization along. When China acceded, it agreed to tough rules that went beyond what other governments were subject to.

One might have expected the ensuing years to be spent enforcing these rules and ensuring China’s proper integration into the trading system. But that didn’t happen to the extent it should have. Distracted by the War on Terror, the United States turned its focus away from China and instead catered to China’s demands in order to win its support for American actions abroad. Fully enforcing trade rules was placed on the backburner.

Critics paper over this reality. Cass criticizes trade proponents as believing that, “[i]f China wanted to steal our intellectual property, manipulate its currency, subsidize state-owned enterprises, and sell us the results for cheap, they were the suckers and we should just enjoy all the stuff.” In reality, WTO rules are designed to prevent these actions by China. There is no WTO prosecutor, however, so in order to change China’s behavior, the United States needs to file complaints. While it has filed a few over the years with some success, it has not filed nearly enough and not on issues related to state-owned enterprises.

Thus, the reality is that trade rules and institutions did offer tools to address China, but the United States failed to fully utilize them. It is not too late to change course, but opponents of trade institutions must get on board with the efforts rather than undermining them.

In practical terms, the globalization debate is not an all-or-nothing proposition between pure free trade and total autarky. Rather, it is about achieving a sustainable political balance that trades off the protectionist demands of corporations and other interest groups against the broader economic interests of the American people. The current global trading system reins in those protectionist demands to some extent, but it also accommodates many of them, leaving us with a particular balance of free trade and protectionism.

Whether we should shift towards the free trade side or towards the protectionist side is an important debate, but in order to have that debate, it is necessary to understand the carefully constructed balance that currently exists and where exactly we lie on the free trade-protectionist continuum.

[Read this on The Commons.] Back to top.

Just Say No to Rejoining TPP

Amb. Robert Lighthizer, Former U.S. Trade Representative

Economic theorists treat globalization as the free market’s natural end state. But trade practitioners know that the opposite is true—that efforts at stitching together the world’s economies are among the messiest sausage-making exercises in policymaking. The protracted process of establishing rules to “liberalize” trade suffers from all the same maladies that free traders warn would accompany protection of the domestic market. Their latest project, reviving the “Trans Pacific Partnership” (TPP), provides the latest and greatest case in point.

As the relationship between the United States and China rapidly deteriorates, many are awaiting to the Biden Administration’s soon-to-be-released economic strategy for the Asia-Pacific. Some in Congress, the business community, and assorted editorial boards are again pushing for the U.S. to rejoin the Trans-Pacific Partnership (TPP)—what was supposed to be a regional free trade agreement between the United States and 11 other countries bordering the Pacific. It was originally an Obama Administration idea, as part of its so-called “pivot to Asia.” Though it had completed negotiations, the Obama Administration never submitted the agreement to Congress, because it was never close to having enough votes for passage. In 2017 President Trump officially pulled the United States out of the TPP, and the other 11 countries eventually agreed to a watered-down deal known as the “Comprehensive and Progressive Agreement for Trans-Pacific Partnership” (CPTPP).

Rejoining the TPP would be a serious mistake. The agreement was oversold from the beginning as a way to increase American exports and create a counterweight to China’s rise. But it would do neither of these things. Instead, it would encourage multinational companies to create supply chains outside the United States and thus generate even more imports, further erode American manufacturing, and increase our already staggering trade deficit. From the perspective of American workers, the terms of the TPP are the weakest of any of our trade agreements. Let’s look at the facts.

First, the TPP would do almost nothing to help create jobs here. We already have free trade agreements (FTAs) with six of the 11 potential member states—Canada, Mexico, Singapore, Peru, Chile, and Australia. These six include almost every major economy in the TPP. The agreement would give the U.S. no new significant market access in any of them. Of the remaining five countries, 95% of the total GDP covered is in one market: Japan. But principal new market access gained in Japan from the TPP would be in the agriculture sector, which the Trump Administration already gained substantially through a bilateral agreement in 2019. So, there is no real benefit to the TPP with respect to Japan either.

The final four countries covered by the TPP are: New Zealand, with a tiny economy and an agriculture sector that could damage ours; Brunei, with a GDP a tenth the size of Cleveland, Ohio; Malaysia; and Vietnam. These last two have small, but not insignificant, economies—each is less than half the size of Ohio—but we already have large trade deficits with both. In Vietnam, for instance, exports to the U.S. represent about 25% of its total economy, and their surplus with us is $81 billion and growing rapidly. Does anyone really think that we will benefit from further integration of our economy with communist Vietnam? Further, considering our enormous leverage in trade talks, why don’t we just insist that they give us market access if we think it could help us? On a smaller scale, the same is true of Malaysia. It is no surprise then that when the International Trade Commission modeled the effects of the TPP, it found no significant new exports for Americans.

The geopolitical argument for joining the TPP is equally fallacious. Although its supporters are a bit vague here, they seem to believe that, if we import more from these countries and increase our trade deficits with them, they will be our friends and oppose China. This is nonsense. It is inconceivable that more trade with any of these countries will change how they relate to China. Six are already FTA partners, and of the others New Zealand and Japan are among our most steadfast allies in resisting the Chinese threat. Does anyone really believe that Vietnam, Malaysia, or Brunei will befriend us and oppose China’s because of trade? Vietnam, for example, has both an 800-mile border and a very difficult history with China. The Vietnamese will certainly take our money and our jobs, but that certainly would not incent them to risk their future by confronting the enormous threat on their border.

The potential gains from TPP are illusory. We will not gain significant new U.S. exports or geopolitical influence. But the potential harms to American workers are all too real. The TPP includes very troubling concessions that would levy substantial costs on American manufacturing and immediately endanger thousands of American jobs in the automobile, auto parts, and steel industries.

Every trade agreement has what are called “rules of origin” that dictate how much of the content of products benefiting from the agreement must be made in the region. NAFTA’s weak rules of origin were a principal reason why so many American jobs moved to Mexico. The United States–Mexico–Canada Agreement (USMCA) negotiated under President Trump reversed them and required that 75% of cars be made in our region and that 40% be made with wages too high for Mexico. The TPP, by contrast, encourages producers to ship jobs overseas by requiring that only 45% of a car be made in the TPP region to obtain duty-free treatment. So, a product could be 45% made in Vietnam and 55% in China, despite China not belonging to the TPP, and it would qualify for special treatment in the United States. This would help China and probably Vietnam but cost us dearly.

Further, weaker rules of origin would supersede the tougher pro-U.S. rules for Canada and Mexico as well. In joining the TPP, we would essentially surrender our gains from USMCA for no additional access to two of our biggest trading partners. The automobile plants that are coming back to the U.S. would head right back to Mexico.

The TPP is bad for American manufacturing workers beyond its weak rules of origin. Unlike the USMCA, it has no enforceable labor or environmental requirements. It has no currency provisions and no sunset provisions to encourage our trading partners to give us better treatment in the future. It includes waivers from “Buy America” requirements and establishes investor tribunals that will encourage outsourcing of American jobs and drive investment away from America. And it largely excludes financial services—a rare area where the United States has a competitive advantage—from the benefits of digital trade access.

The TPP is a bad agreement, and joining it now would be a serious mistake. Doubling down on globalization would not only jeopardize American interests, but ignore lessons of the last three decades. If we are worried about China and its growing influence in the Pacific, as we should be, the most important thing we can do is to trade less with them. China’s $320 billion annual trade surplus with us is a major reason for their economic growth and military build-up. The best counter to China and the best service we can provide our allies is to have a strong U.S. economy, a strong industrial base, and a lower trade deficit.

[Read this on The Commons.] Back to top.

Free Trade Isn’t Always Better

Ron Hira, Howard University

Oren Cass takes on the entrenched belief held by the U.S. economics profession that countries should always pursue a policy of free trade. He argues that Smith and Ricardo have been misunderstood for generations because their key assumptions around capital mobility were omitted as the arguments were passed down. The results have been disastrous. I won’t opine about the specific omissions for Smith and Ricardo’s work, but instead focus on a recent episode that interrogated what trade models say about the economic implications of globalization.

Free trade is a principle instilled early in an economist’s training where straying from the orthodoxy is grounds for excommunication. The core claim is that freer trade is always welfare-enhancing, even in cases where the trading partner is protectionist. Economists do acknowledge that trade has distributional impacts that create losers. Facing new competition, some workers lose jobs or have their wages depressed, and some companies lose revenue or may be put out of business. But economists claim that such losses are very small because the flexibility of American markets makes adjustment—reabsorption into equally productive activities—virtually effortless. Of course, it helps that all trade models assume full employment and GDP at potential. Some proponents go so far as to say that workers should welcome being displaced because it frees them up to do more interesting and rewarding work. Plus, any losses can easily be redressed since the gains from trade are more than sufficient to compensate the losers. Let’s examine both the welfare and distributional effects.

The blanket welfare claim came under fire from within during the early 2000s debates over outsourcing. Paul Samuelson, the father of modern trade theory, pointed out that mainstream economists were publicly promoting the “polemical untruth” that freer trade is automatically welfare-enhancing. Meanwhile, Ralph Gomory and William Baumol extended the standard models to demonstrate that there are:

“inherent conflicts in international trade … [where] An improvement in the productive capability of a trading partner that allows it to compete effectively with a home-country industry, instead of benefitting the public as a whole, may come at the expense of the home country overall.” [emphasis added]

The response from the mainstream economists was begrudging acknowledgement that these arguments might technically be correct, but no plausible real-world scenario would ever be welfare-reducing.

My takeaway from these debates is that trade models allow for many different outcomes and have limited utility in today’s environment of capital mobility. The trajectory, not the current state, of a country’s comparative advantage is what matters. Countries take active steps to improve that trajectory—e.g., by investing in education and infrastructure—but companies also have significant power to shift productive capabilities across trading partners. The U.S. has chosen not to regulate or constrain such transfers. A firm that offshores is systematically transferring productive capabilities—knowledge, tools, and technologies—from one country to another. It isn’t a simple exchange between countries of say a t-shirt for software. Instead, it is making your competitor better in areas where you have an advantage, and that can make you poorer. This kind of capital mobility couldn’t have been foreseen by Smith and Ricardo.

Turning to the labor impacts, anyone who has experienced a layoff or knows someone who has realizes that “adjustment” is far from easy. The financial and psychological losses are significant and can sometimes be debilitating. Finding a new job is not easy and is especially difficult when your entire sector is under new competition from abroad. In fact, trade-related losses have been much worse and more enduring than predicted. More than a decade too late to make a difference, David Autor and his co-authors discovered that difficulties from adjustment can extend well beyond individuals’ losses to whole communities and regions with their influential work they dubbed the China Shock.

Despite the predicted bountiful spoils from liberalizing trade, actual efforts to compensate the losers have been less than halfhearted. Trade Adjustment Assistance (TAA), created in the early 1960s as part of President Kennedy’s round of trade liberalization, has been the primary remedy to soften the blow. TAA is widely and repeatedly criticized for being ineffective. Critics argue its only effect is to delay a worker’s reentry to the labor market at their new lower and apparently more deserving market-clearing wage. A decade after it was created, the AFL-CIO had lost faith in the program with its president George Meany describing it as “burial insurance.” Recognizing that garnering support for expanded trade required more than just an enhanced TAA, Brookings scholars Kletzer and Litan proposed the alternative of wage insurance, which is essentially a bribe for workers to more quickly accept their downward mobility.

Meanwhile, the winners from globalization have successfully argued that the appropriate policy response is more public spending on education as well as research and development. Both are worthwhile recommendations, but they do nothing to address the root problem—that is, the misalignment of capital and labor interests—and will be much less effective than in the past as globalization eats away much of the gains. A country invests taxpayer dollars into research not to create research jobs, but in the hope that it captures a large share of the downstream design, development, and production jobs that flow from it. But those downstream jobs are much more likely to leak offshore as companies become more sophisticated and efficient at offshoring the work. Sridhar Kota describes it succinctly as the “invent here, manufacture there” corporate strategy that has become pervasive.

In sum, not only have the losses induced by trade liberalization been undercounted, they have never been taken seriously, and there are few good ideas about effectively compensating the losers—much less stemming the bleeding.

Cass’s contribution reinforces the conclusion that there are good reasons to doubt that the current version of globalization will be welfare-enhancing or benefit most Americans in the long run. His solution—to bound the market to create an interdependence between capital, labor, and consumers—may need some rebranding because it could be difficult explain and sell, but the specific proposals accompanying the essay are both sensible and refreshing.

As Cass rightly concludes, the root cause of many of our economic problems is that corporate (capital) interests have diverged from those of workers (labor) and that restoring their mutual dependence is paramount. The ills stemming from globalization are symptoms of this more fundamental problem.

For the past 20 years, business executives stumbled into easy and enormous profit windfalls by transferring jobs and technologies to places like China, India, and Mexico, but in doing so they also created competitors. There may be a ray of hope from that development. The new generation of CEOs won’t have it so easy and may find their interests more aligned with the country. It’s happened before. In the 1980s, facing new competition from Japan, CEOs from leading industries went to Washington begging for protection and got it.

[Read this on The Commons.] Back to top.

It’s Time for a Neoclassical Economic Reckoning

Jonathan Askonas, Catholic University of America

Oren Cass’s essay demonstrates how the advantages of industrial policy, apparent to some of the founders of economics and foundational to the success of the United States, were carefully airbrushed out by advocates of free trade in the 20th century. But he goes too easy on the neoclassical economists. Not only did their defenses of trade and attacks on industrial policy rely on intentional misrepresentations of economic theory, but the actual international trade system never met the bar required by their own theory to be considered beneficial.

Neoclassical economists relish the elegant simplicity of David Ricardo’s theory of comparative advantage, which slots neatly into standard models of production, supply, and demand. Using the standard model, any economics undergraduate can produce a “proof” that free trade results in an absolute increase in social welfare, as each society focuses on producing the goods and services it is best at making.

But of course, an enterprising student is likely to raise his hand to point out that free trade leads to all sorts of obvious social welfare losses: jobs lost, factories shuttered, people displaced, and so on. At which point his professor will point to two key assumptions in the model: that the balance of trade and currency purchasing power reach a new long-term equilibrium, and that “losers” from trade are fully compensated for their losses by the gains from trade. The experience of globalization suggests that neither assumption is easily met in practice.

First, consider the case of opening of trade with China. Neoclassical economists believed that the assumptions underlying their model for free trade would be met in the case of China: the trade balance and currency purchasing power would reach a long-term equilibrium.

Despite some conciliatory currency reforms undertaken to grease the path towards WTO accession, the Chinese Communist Party has never backed away from the manipulation of the yuan (including the use of capital controls and invasive central bank operations) in order to maintain the artificial export competitiveness of Chinese industry, at the expense of the Chinese worker.

With the complicity of Wall Street elites, they devised an audacious new strategy to maintain this artificial advantage while buying loyalty and influence in the United States. They would pour all of the dollars earned from exports back into the financial system, buying U.S. Treasury bonds, investing in real estate, and acquiring stakes in American companies. Not only did this result in substantial outflow of ownership from the United States, but it also created an artificial demand for the U.S. dollar, channeled through industries disproportionately likely to employ or benefit American elites. As a result, despite massive trade imbalances, the dollar never fully depreciated against the yuan, and manufacturing jobs kept flowing out of the U.S.

This “class politics of the dollar system” might not have been intolerable had the other key assumption of the economists’ model been met: that the “losers” from trade be compensated from the gains from trade. Though a foundational principle of the free-trade model, it has rarely been tried in practice. Government programs exist to compensate and re-train workers who have lost their jobs due to trade, but research suggests that spending on these programs accounts for less than 10% of the trade-related wage losses.

Second, many neoclassical economists seemed to assume that not government programs but increased economic growth and reduced costs to consumers would more than make up for trade losses. But this assumption ignores the non-substitutability of cheap consumer goods and life essentials. Even as it can afford to consume more electronics and clothing, the American middle class finds itself increasingly pressed to afford goods affected by Baumol’s “cost disease” and increasing labor costs, including housing, health care, and education.

More worryingly, so-called “noneconomic” factors were roundly ignored. Factory closures and job losses often forced workers to choose between moving to more economically dynamic parts of the country or staying near family support networks and social ties. The combination of microeconomic and macroeconomic hollowing out led to a surge in “Deaths of Despair” among non-college educated white men, who bore the heaviest brunt of the “China Shock” and other trade shocks.

In light of its basic failures of prediction, mainstream economics now faces a reckoning, and industrial policy is making a comeback among policymakers. But even as the catastrophe of actually existing globalization suggests serious flaws in the standard model, even those who continue to accept it must reckon with the distance between its assumptions and reality. Understanding what has befallen the American worker does not require one to reject the neoclassical economic consensus, only to follow its arguments to their logical conclusion.

[Read this on The Commons.] Back to top.

Why the Free Trade Debate Needs the Real Adam Smith

Paul Winfree, Heritage Foundation

Oren Cass is right to note that modern economists largely misunderstand Adam Smith. But the misunderstanding runs deeper and traces even further back than editorializing in 20th-century textbooks. For more than two centuries, scholars have ignored the relationship between Smith’s political philosophy and economic analysis. It began with Smith’s own friend and biographer, Dugald Stewart, who, in an effort to preserve his legacy and make his ideas more politically acceptable, divided Smith’s views on economic freedom and political liberty. Scholars and economists today maintain this artificial divide, characterizing Smith as a conservative on economic issues like free trade and small government, while overlooking his political views on egalitarianism, toleration, anti-imperialism, and religious freedom.

But Smith’s actual views cannot be understood without both halves. Consider his general opposition to state intervention. For Smith, the state was not the right institution to regulate trade because government policy was about force. Smith believed that you cannot force people to trade just as you cannot force them to exhibit virtuous behavior. They must do it willingly. Therefore, Smith spent much more time discussing the Golden Rule—“to do unto others as you would have them do to you”—than he did the Invisible Hand. Political philosophy mattered as much as, if not more than, pure economic analysis.

This fuller picture of Adam Smith is sorely needed in discussions about globalization. One of the central questions in economic history is why the conditions of people improve in some places but not in others. Interest in this question has grown since the middle of the last century as real income in many large societies has dramatically increased, global poverty has fallen, and more countries have democratized. Scholars have found that particular cultural, social, and political arrangements—namely the security of property rights, attitudes towards scientific progress, access to financial markets, and universal education—are important parts of the answer. But even these arrangements alone are insufficient.

Maintaining markets that are open to external competition is also important to economic development. Nobel laureate Douglas North and his coauthors have suggested that these “open-access orders” are essential to achieving both economic growth and political stability. Societies that pursue a policy where prospective entrepreneurs can freely compete with established businesses helps create a political economy in which systematic public corruption is kept in check. Without open-access policies, political elites offer economic protection (e.g., monopolies or tariffs) to those in their political coalition and create economic rents that they exploit at the expense of everyone else. This corruption is toxic to economic growth and fosters an attitude of mistrust within society.

Adam Smith would have understood the importance of open-access orders because he made the argument himself. Smith was not primarily concerned with state intervention, and he even supported state action to provide public education and religious protection, while subsidizing the arts, among other things. However, Smith was very concerned with the corruption of markets by politicians. Political concerns about collusion between politically well-connected merchants and government formed the basis for Smith’s assailment of mercantilism in The Wealth of Nations. Smith was perfectly blunt in calling this political protectionism “a conspiracy against the public.”

The case for an open-access economy therefore does not preclude regulation or even certain trade restrictions. But restrictions to markets cannot be unequally applied. This includes politically motivated development of the private sector over the protection of markets. Evidence from nations where state-led development is the norm, such as modern China, suggests that state involvement is associated with public corruption and may increase economic growth but only for a period.

The real Adam Smith believed that for free trade to exist it had to be reciprocal—that is, between equal trading partners who treated each other’s preferences as their own. Without reciprocity, exchange is no longer free trade, but rather some level of extortion. Today’s economic policymakers would be well advised to return to Smith for wisdom that does not expire.

[Read this on The Commons.] Back to top.

Did Globalization Cause the Great Stagnation?

Caleb Watney, Institute for Progress

Analyzing the effects of any long-run macroeconomic trend is admittedly a difficult affair. After all, typically more than one big trend is happening at a time, which means that isolating the impact of any particular force requires careful and thoughtful empirical analysis. It is somewhat troubling then, that “Where’s the Growth?” doesn’t appear to draw any clear causation between the alleged malign forces of globalization and the declines in productivity and economic dynamism.

Put more straightforwardly, it is true that American productivity growth and economic dynamism has been on the decline for decades. But these are much broader trends that reams of empirical work have connected to self-imposed housing scarcity, demographic headwinds, an overbearing regulatory environment, a general societal decadence, and the slow process of new ideas getting harder to find. Given what we know about these other factors, do we have strong evidence to suggest that globalization played a large (if any) role in the Great Stagnation?

It’s possible that, absent globalization, many of the same trends would have been worse—the fact that the U.S. manufacturing sector appears to have been made worse off by the Trump Administration’s tariffs and trade wars is certainly revealing.

Beyond the general slowdown in science and technology, let’s take a few of the key charts from “Where’s the Growth?” and examine the more complicated macro stories that may be hiding underneath.

First, the shift to intangible assets complicates trade deficits. Put aside the question of whether the trade deficit is a meaningful economic concept at all, or whether the suggested policies in “The Balancing Act” would actually decrease the deficit (some likely would, others would likely exacerbate it). If we are going to measure it properly, then we need to consider the massive shift toward intangible assets in the global economy that aren’t captured by the traditional metric. Patents, know-how, trademarks, copyrights, brands, management techniques, and trade secrets are some of the core building blocks of the modern economy, and ones in which the U.S. specializes. One recent attempt to account for only a few of these channels found that including intangible assets shrank the U.S. trade deficit to half its original size and has declined since 2011 as intangible assets continue to grow in scope.

Second, it is notable that manufacturing productivity and output don’t fall sharply with the entrance of China into the World Trade Organization (WTO) in 2001, as one might expect if globalization were the culprit. Both measures show on-trend annual growth until 2008–09 and then fail to pick up afterwards. This would seem to indicate that the painfully slow recovery from the Great Recession has much more to do with these declines than globalization does. And the causal story here is straightforward: The Federal Reserve consistently raised rates during the early 2010s before the labor market had reached full employment, resulting in a “lost decade” with depressed worker bargaining power and little incentive for employers to invest in the invention or deployment of new labor-saving technologies. This interpretation would also explain the early uptick in manufacturing productivity after 2019 as the labor market moved much closer to full employment.

Third, the same phenomenon likely played a hand in the overproduction of college degrees, as workers looked to credentialing as a means of competing in a loose labor market (and led other workers to accept lower-wage service sector jobs). Consider the fact that employers finally appear to be reducing their degree requirements as the labor market has tightened. While globalization could theoretically play a role in a loose national labor market in the form of offshoring, both the timeline and the magnitude of these trends appears ill-fitted.

None of this is to say that globalization has been costless—and indeed I’m inclined to agree that it was oversold on some margins. “Where’s the Growth?” is on the strongest empirical ground when discussing the localized labor market impacts from the “China Shock,” as research from David Autor and others has shown. But as Niskanen’s Samuel Hammond has pointed out, this was far more a failure of domestic investment in active labor market policy and a strong social safety net than it was a failure of trade policy. An America that tries to isolate itself from shocks rather than prepare for them proactively will be vulnerable to future disruptions of all stripes.

If we want to restore American dynamism, we have to be rigorous about identifying the underlying causes of its decline. There are many strategic and geopolitical reasons to boost domestic high-tech manufacturing capacity and for the U.S. to be wary of certain Chinese investments backfiring. But blaming a generic globalization boogeyman is an analytical error in the other direction.

[Read this on The Commons.] Back to top.

How to Bound the American Market

Michael Stumo, Coalition for a Prosperous America

In his essay, Oren Cass correctly argues that a well-functioning capitalist system requires a “bounded market” within a nation-state that imposes interdependence on labor, capital, and consumers. Frictionless capital mobility across borders, in contrast, decouples the interests of investors from their country and their workers.

Global capital flows have become massive in volume, unrelated to the size of the real economies of the world. Large capital inflows and outflows seem intuitively beneficial to a country, but the reality is that they can cause surges and imbalances of production, consumption, exchange rates, and inflation. They also cause income inequality, deindustrialization, and economic distortions that gave rise to the U.S.–China economic rivalry.

Adding “friction” to cross border flows of goods (broad tariffs) and capital (charges on cross border capital flows) is needed for countries to reclaim control of their economies for balanced development. Any tariffs or capital flow charges need not increase overall taxation because domestic taxes could be lowered in proportion to the new revenue.

Only a nation-state possesses the policy tools necessary to successfully manage an economy that generates broadly shared and steadily growing prosperity. Those tools include a common currency, banking system, labor market, regulatory regime, monetary policy, and fiscal policy. Free trade can occur within a nation-state but not with other nation-states, because all those policies often overwhelm targeted tariff moves.

When China joined the World Trade Organization (WTO), its tariffs were lowered, but the bilateral trade balance with the U.S. worsened dramatically. China devalued its exchange rate, increased industrial subsidies, and refused to allow many of its companies to buy inputs from abroad. China is now the second biggest economy in the world, has developed many industries at large scale, and has displaced many American companies that previously produced those goods.

It is a core function of government to win the global competition for good jobs and industries as Jim Clifton, CEO of Gallup, has observed. If the government can’t do so, the citizens will vote for different leadership.

Yet neoliberals focus on cheap goods today and improving efficiencies within the scope of current production—a static analysis. They lack the tools or the motivation to calculate the future benefits of developing new or expanded domestic supply chains, making sure they have a customer base to get production to scale, and protecting them from incumbent foreign competitors. Ricardo devotees may believe comparative advantage is somehow natural and static, but it is created by the policies of man, not the grace of God.

A proper industrial strategy would produce the results that characterize a successful political economy and society: increasing real wages, constant innovation, expansion into new industries, productivity growth, and broadly shared prosperity.

American Compass is correct in pointing out that “the underlying problem is one of imbalance.” In the U.S., imbalances between wealthy states and poor states have been mitigated by fiscal and monetary policies, but its imbalances with other countries persist.

Exchange rate misalignment is the biggest cause of such trade imbalances. Global capital has detached from real economies and simply seeks high returns or safety in the U.S. The glut of global capital buying dollar-denominated financial assets pushes the dollar higher than it would otherwise be. An overvalued dollar makes imports cheaper and exports more expensive in the global market.

A U.S. policy to realign the dollar to a trade-balancing equilibrium price would immediately move the U.S. current account towards balance. Finance ministers across the globe know that exchange rates impact “external competitiveness,” yet U.S. monetary policy authorities resist using the exchange rate to achieve trade goals, and most American trade policy “experts” do not grasp how capital flows drive trade imbalances.

The Coalition for a Prosperous America (CPA) has shown how a variable fee on foreign capital inflows (e.g., a market access charge) is needed to moderate the dollar exchange rate toward a trade balancing target. A market access charge that drives the dollar exchange rate to trade-balancing levels would dramatically boost growth, create jobs, and grow incomes in the real economy.

The “bounded market” is a worthy and achievable goal for the United States. Other countries manage exchange rates and capital flows for trade competitiveness and are not “isolationist” for doing so. Their trade with other countries remains vigorous, but balanced—neither exports nor imports predominate. Industrial strategy in the context of balanced trade can and should improve the industrial mix with increasing productivity, rising real wages, relentless innovation and protection of national security.

[Read this on The Commons.] Back to top.

Globalists Finally See Reality

Clyde Prestowitz, Economic Strategy Institute

On March 3, 2018, The Economist declared that the free world had “made the wrong bet” in trying to make China “a responsible stakeholder in the rules based, liberal global order.” Last week, major hedge fund manager and long-time globalization champion Larry Fink declared that “globalization is over.”

When the former high priests of globalization admit it’s not working, the time has come not only to ask why they’ve changed their minds, but also why they were so wrong for so long. Oren Cass’s exposé of the abuses of classical economic theory offers a valuable starting point. But the problems lie even deeper and extend much further.

The fundamental flaw of globalization has been that academics and policymakers have strived to apply a theory of free trade developed in 1817—Ricardian comparative advantage—to the world of the late 20th and early 21st century. The theory depends on some key assumptions: absence of economies of scale, fixed exchange rates, constant full employment, absence of innovation, absence of cross border investment, absence of economics as an element of national security, and complete neglect of carbon emissions.

In the early 19th century, these assumptions were not unreasonable. Exchange rates were fixed to gold. Farming, an industry of diseconomies of scale (costs rise with production), was the major driver of the economy. Employment may not have been constantly full, but there was no unemployment compensation. And while innovation occurred sometimes by accident, it was not yet a major economic factor. There were few corporations, and with some notable exceptions, very few of them invested abroad. National security depended on having a lot of soldiers, and no one knew what greenhouse gases were.

The global economic environment of the past 50 years has been almost diametrically opposite that of 1817. Exchange rates float, and many countries actively intervene in currency markets to undervalue their currencies to favor export-led growth strategies. Most major industries (e.g., automobiles, aircraft, semiconductors, computers, steel, lawn mowers, and so on) are characterized by economies of scale. Cross-border investment is greater than cross-border trade. Innovation is the most important driver of economic growth as well as a key element of national security. Unemployment rates are high as often as they are low. Economic development is as important to national security as armies, and if the cost of carbon is not included in pricing, there will soon be no economies to worry about.

A major reason why it took so long for these false assumptions to come to light was the almost exclusive focus of Washington’s foreign policy on geopolitical issues. In the mid-1980s, as Japan’s export industries were killing off their American competitors, I sat in White House meetings in which National Security Council staff declined to take any measures to halt some unfair Japanese trade practices. The reason stated: “We need those bases. Now that’s the bottom line.” Geopolitical considerations trumped trade, economic, and competitive issues every time.

This was partly the result of hubris, and partly the result of the inculcation into the Anglo-American intelligentsia an unquestioning faith in free trade. For decades, students were taught that free trade is always and everywhere a win-win proposition. Indeed, they were taught that even if a country puts rocks in its harbors to prevent imports from entering, its exports should be welcomed by other countries. Free trade was a kind of religious dogma, and those who questioned it were subject to being cast into outer darkness.

A final pillar of the dogma was provided by global corporations that—free trade assumptions to the contrary notwithstanding—invested and exported back to America from countries that subsidized the investment, purposely kept their currencies undervalued to stimulate export-led growth, banned labor unions, failed to recognize fundamental human rights, and stole intellectual property. The corporations made out like bandits, and when their shift to production abroad caused the loss of millions of American jobs, the economists said not to worry. They promised that inexpensive imports were good for consumers, and the laid-off workers could easily move away from their families and long-time homes to find jobs elsewhere. Of course, the economists never quantified the long-term costs of these disruptions or the inevitable loss of skills and innovation due to the displacement of workers.

Fortunately, reality has at last caught up with the myth—not so much because the myth is wrong as because it has itself become a threat to national security. After all, if all the cutting-edge technology production is to be done abroad, how will America protect freedom in the age of Aquarius?

[Read this on The Commons.] Back to top.

What Conservative Critics of Globalization Miss

Anthea Roberts & Nicolas Lamp, Australian National University & Queen’s University

It is hard, nay impossible, to find a more sophisticated conservative critique of globalization than that articulated by Oren Cass. Perhaps because Cass was once a card-carrying member of the economic establishment himself, he has an exceptionally clear sense of some of the problematic assumptions that have underpinned that establishment’s high level of support for globalization over the past three decades.

Many, including the current administration, would agree with much of Cass’s diagnosis. There is now a broad consensus that globalization has had a devastating impact on American manufacturing communities, that it has primarily benefited the owners of capital instead of American workers, and that the United States needs new economic policy tools to address the challenge of China’s rise.

We do not wish to quibble with Cass’s critique but instead seek to place it in conversation with other critical narratives about globalization that we explore in our book, Six Faces of Globalization. Cass styles his contribution largely as a conservative answer to the traditional establishment narrative, but what if we imagine him in dialogue with critics coming from other perspectives? Our aim in doing so is to highlight some of the analytical and normative choices embedded in Cass’s perspective, which may in turn affect possibilities for alliances across diverse perspectives on particular policy choices.

Notwithstanding the broad consensus that now exists on the perils of globalization, there are aspects of Cass’s framing that mark his critique as coming from the right-of-center. First is the lack of concern for the wellbeing of people outside of the United States. The establishment narrative proudly points to the fact that integration into the global economy helped lift hundreds of millions of people out of poverty in developing countries. For Cass, the effect of U.S. policies on the livelihoods of people in developing countries is something that might be of concern to a “benevolent global dictator” but should not factor into the calculations of U.S. politicians. In his account, working-class solidarity does not reach beyond American shores.

This focus contrasts sharply with some left-wing critiques of globalization. As the journalist William Greider has argued, the “only plausible way that citizens can defend themselves and their nation against the forces of globalization is to link their own interests cooperatively with the interests of other peoples in other nations—that is, with the foreigners who are competitors for the jobs and production but who are also victimized by the system.” Similarly, though less radically, the Biden Administration’s “worker-centered trade policy” professes concern with the wellbeing of workers both “at home and abroad.”

These differences in emphasis have policy implications. Do you take lower labor and environmental standards in other countries as a justification for imposing tariffs to “level the playing field”? Or do you double down on working with those countries to improve their standards? Cass’s framing leans heavily towards the former approach; the left would advocate the latter.

A second way in which the left-wing critique differs from and complements Cass’s perspective is in emphasizing how domestic policies shape the impact of globalization. Cass’s account gives the impression that all was well with the U.S. economy until roughly the start of the new millennium, when China joined the World Trade Organization (WTO). The left instead points out that a key cause of the high levels of inequality in the United States, namely the decoupling of wage and productivity growth, started much earlier, in the late 1970s and 1980s. On this view, it has primarily been domestic policies—including anti-union laws, the fall of the real value of the minimum wage, the housing crisis precipitated by restrictive zoning, and rampant financialization—that have kept large swaths of the U.S. population from sharing in the spoils of globalization. Cass argues that globalization has increased the need for redistribution, while the left would argue that it is these sorts of pre-distributive policies that rig the domestic market in favor of the rich.

To be sure, Cass does not let domestic policy off the hook, but his emphasis on the threat that foreign goods and money pose to the U.S. economy and social fabric suggests that trade policy bears significant, perhaps even primary, responsibility for the U.S. economy’s current ills. Some on the left would ask why, if this is so, many other developed economies have fared so differently. No other major developed country has experienced a backlash against international trade on the scale that we have seen in the United States. Nor have others experienced the same levels of inequality.

There are two other critiques of globalization that receive little airtime in Cass’s account. He persuasively explains how globalization has destroyed the coincidence of interests among American capitalists and American workers and thereby diminished the vitality of the U.S. economy. But globalization is in tension with other values as well. A geo-economic narrative that highlights the security risks of economic interdependence is quickly becoming the new establishment consensus in Washington. Given the often right-of-center inclination of this perspective, it is surprising not to see it take a more central role in Cass’s framework.

In many ways, the geo-economic narrative and Cass’s perspective are aligned. Thus, one could argue that companies should reshore their production both to revive domestic manufacturing (which appears to be Cass’s priority) and bolster national security. However, there are also tensions between the two perspectives. A geo-economic strategy requires close cooperation with allies to be sustainable—the coalition that the Biden Administration is building vis-à-vis Russia is an example. By contrast, the vision of globalization that American Compass advocates places balancedtrade front and center, without differentiating between friend and foe in the pursuit of this objective.

The other striking omission from Cass’s framework is a discussion of the climate crisis. The global diffusion of Western patterns of production and consumption has undeniably played a central role in bringing us into an ever more precarious world of climate change-related extreme weather events, including storms, floods, droughts, heat waves, wildfires, and rising sea levels. For many governments and their constituents, arresting these developments is a principal challenge for the international economic order. From their perspective, a vision of the future of globalization needs to speak to this challenge.

Economic globalization and economic policymaking are complex and multifaceted. The best chance for achieving meaningful change lies in building alliances among proponents of different narratives that often see and value different things. Cass and American Compass are leading the conservative critique of globalization, but translating that critique into political change requires an understanding of how that perspective overlaps with and differs from rival accounts of who wins and who loses from globalization.

[Read this on The Commons.] Back to top.

Recommended Reading

Talkin’ (Policy) Shop: Balancing U.S. Trade

On this episode of Policy in Brief, Oren Cass is joined by American Compass policy director Chris Griswold to discuss how U.S. trade fell so far out of balance—and some ideas for how to rebalance it.

Where’s the Growth?

The era of globalization has coincided closely with the onset of precisely those problems that a clear-eyed analyst might have predicted and delivered outcomes contrary to the ones its ideologues envisioned.

Regaining Our Balance

How to Right the Wrongs of Globalization